MicroStrategy's Game-Changing Bitcoin Strategy: Michael Saylor's Vision for a Digital Reserve

"MicroStrategy: Your Gateway to Bitcoin – Unlocking Access, Amplifying Returns, and Embracing the Future of Digital Assets"

Introduction: Bridging Historical Acumen with Digital Pioneering

Imagine securing a prime piece of real estate for a mere $24—a seemingly inconceivable bargain. Yet, in 1626, the Dutch accomplished just that by purchasing Manhattan. At first glance, it appeared to be a modest transaction, but in hindsight, it became the cornerstone of one of the world's most lucrative real estate markets, now valued at over $4 trillion.

"Why would you bet on Goliath when you can bet on David?" Michael Saylor, CEO of MicroStrategy, often muses. This profound philosophy underpins his audacious ventures into the cryptocurrency realm, particularly his unwavering commitment to Bitcoin. Similar bold maneuvers, such as the California Purchase in 1848 and the Alaska Purchase in 1867, were initially perceived as high-risk investments but ultimately epitomized remarkable foresight and strategic brilliance.

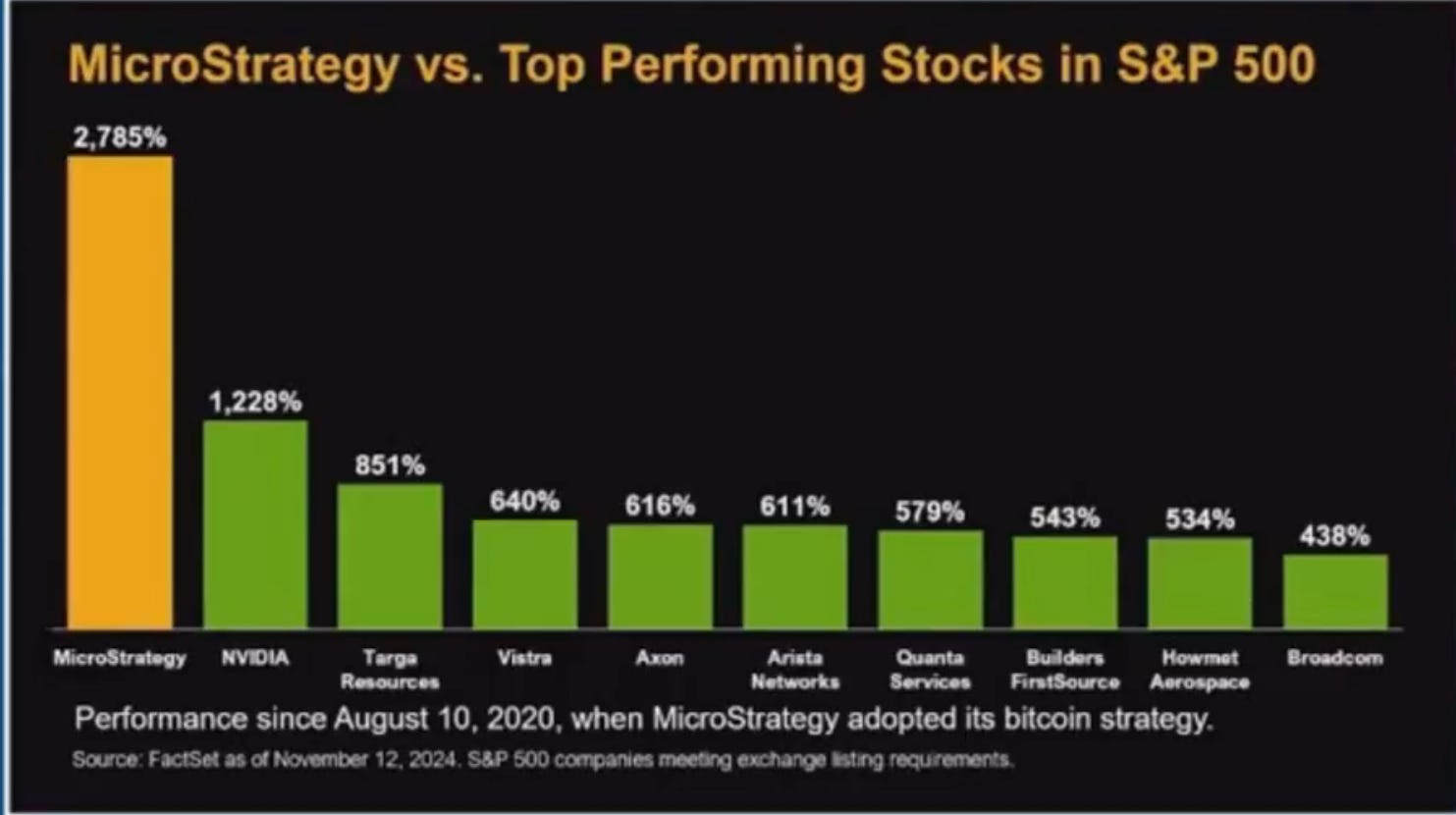

Fast forward to the digital epoch: In 2020, MicroStrategy, under Saylor’s visionary leadership, initiated its journey of acquiring Bitcoin as its principal treasury asset. Dubbed the "Digital Manhattan," Bitcoin symbolizes the new frontier for wealth accumulation, driven by its finite supply and surging global demand.

As CryptoGlobe aptly observes:

"Bitcoin is not just a digital asset; it’s a revolutionary technology that redefines how we think about money and value storage."

This discourse delves into:

The parallels between Bitcoin and historic land acquisitions.

An analytical breakdown of MicroStrategy’s $2.6 billion convertible notes offering.

The ascendancy of Bitcoin as a linchpin of the digital economy.

Navigating regulatory landscapes, institutional endorsements, and the proliferation of Bitcoin-centric enterprises.

The transformative proposition of a Bitcoin Reserve and its implications.

An introspective look into a personal portfolio comprising MicroStrategy shares.

Strategic insights for investors navigating this rapidly evolving terrain.

1. Lessons from Historic Acquisitions

History abounds with narratives where audacious investments reaped monumental rewards. By dissecting these pivotal instances, we can glean invaluable insights into Bitcoin's contemporary significance.

1626: The Manhattan Purchase

Cost: 60 guilders (~$24 USD).

Today’s Value: Over $4 trillion.

"Sometimes, having limited resources can lead to monumental gains when used wisely," Saylor emphasizes. The Dutch acquisition of Manhattan was a strategic masterstroke that fundamentally reshaped economic landscapes for centuries.

1848: The California Purchase

Cost: $18 million paid to Mexico.

Today’s Value: $7.78 trillion.

"Investing early in transformative regions fuels massive economic growth," Saylor notes. The California Purchase unlocked vast resources and opportunities, underscoring the potency of visionary investments.

1867: The Alaska Purchase

Cost: $7.2 million paid to Russia.

Today’s Value: Over $1 trillion.

"Sometimes, what seems like a questionable purchase can turn out to be a treasure trove," he adds. Initially dubbed "Seward's Folly," Alaska revealed immense natural resources, validating the foresight behind its acquisition.

2020 Onwards: MicroStrategy’s Bitcoin Accumulation

Cost Basis: $16.518 billion for 331,200 BTC.

Today’s Value: $31.203 billion.

"Bitcoin today mirrors these historic land deals, offering potential for incredible growth driven by its scarcity and rising demand," Saylor asserts. MicroStrategy’s strategic accumulation underscores Bitcoin’s potential as a long-term, value-generating asset.

As Wikipedia aptly states:

"Bitcoin is the apex property of the human race."

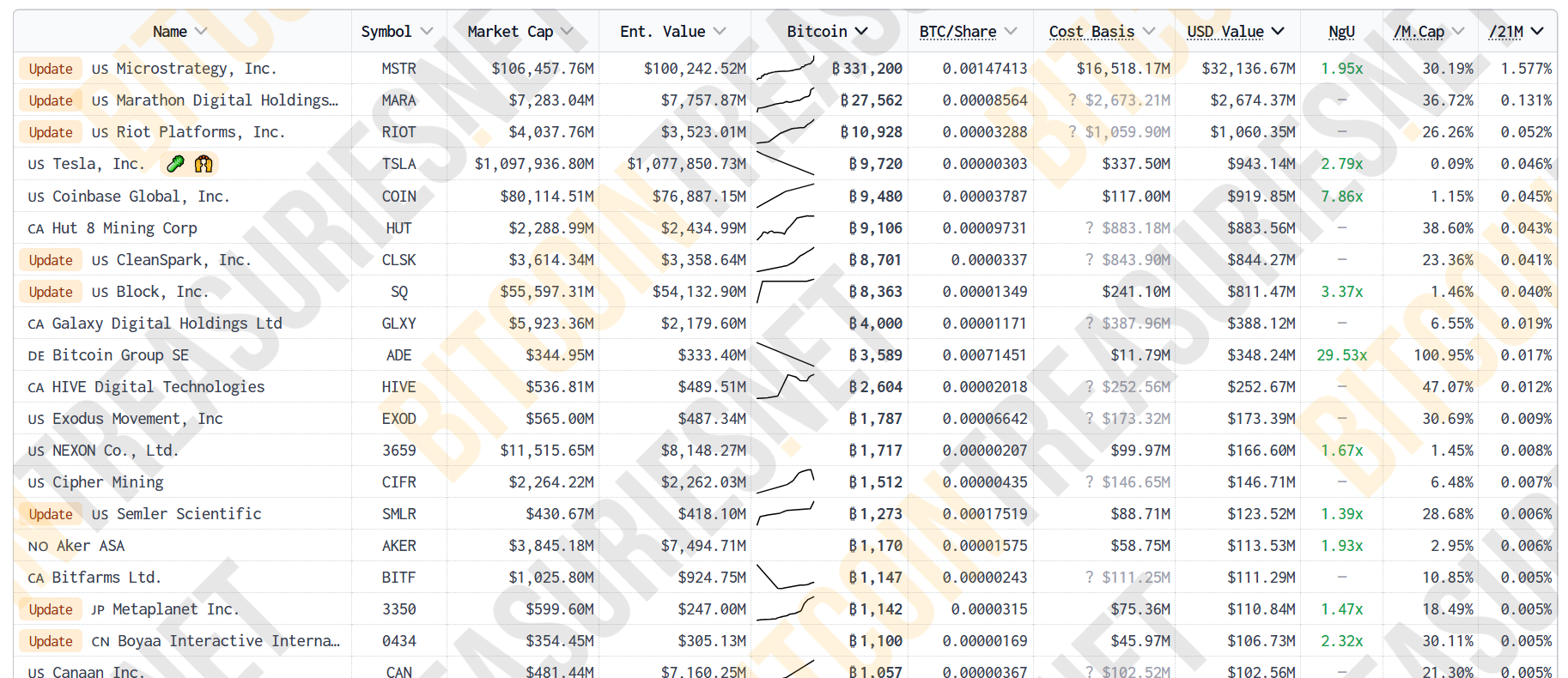

2. MicroStrategy’s Bitcoin Holdings: The Quantitative Edge

To comprehend the profundity of MicroStrategy's Bitcoin investment, let's dissect the key metrics that illuminate its strategic significance.

Key Metrics (as of November 20, 2024):

Bitcoin Holdings: 331,200 BTC.

Valuation: $31.203 billion.

Unrealized Gains: $14.685 billion (+88.9%).

Average Cost Per Bitcoin: $49,874.

Stock Performance:

Stock Price: $473.83 (+10.04%).

Market Cap: $106.5 billion.

BTC Per Share: 0.00147413 BTC.

With a mere $60 million in cash reserves, MicroStrategy has unequivocally embraced Bitcoin as its principal treasury asset. "We're not just buying Bitcoin; we're betting on the future of digital capital," Saylor declares. This decisive move accentuates the company's unwavering commitment to Bitcoin, positioning it as a Bitcoin-centric enterprise. By prioritizing digital assets over traditional cash reserves, MicroStrategy is making a calculated bet on Bitcoin’s enduring value proposition.

According to Financial Times:

"MicroStrategy now holds approximately 331,000 bitcoin worth about $31 billion, making it the largest corporate owner of the cryptocurrency."

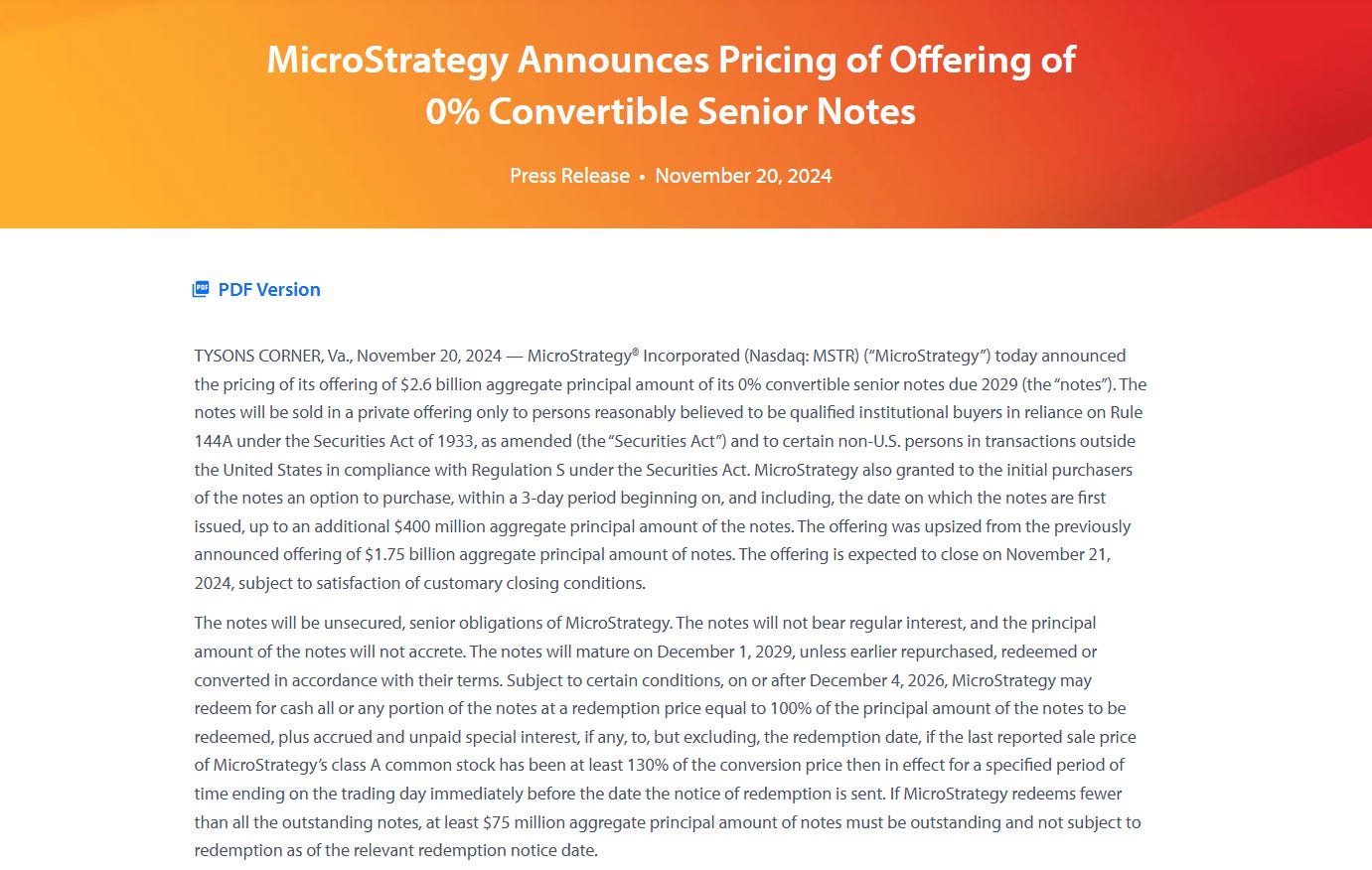

3. MicroStrategy’s Financial Strategy: The $2.6 Billion Convertible Notes Offering

MicroStrategy's foray into Bitcoin is not a capricious endeavor; it is underpinned by a meticulously crafted financial strategy.

Details of the Offering:

Principal: $2.6 billion (increased from $1.75 billion).

Conversion Price: $672.40 (a 55% premium).

Maturity: December 2029.

Proceeds: Estimated $2.58 billion (or $2.97 billion if all options are exercised).

Strategic Purpose:

The proceeds from these convertible notes are earmarked for further Bitcoin acquisitions and to bolster various company initiatives. "By using convertible bonds, we secure substantial funds at a favorable rate, allowing us to buy more Bitcoin and amplify our BTC yield," Saylor elucidates. This approach not only reinforces their commitment to Bitcoin but also exemplifies their innovative financing methodologies aimed at expanding their digital asset portfolio.

"Our focus remains to increase value generated to our shareholders by leveraging the digital transformation of capital," he adds.

4. Bitcoin as Digital Real Estate

Michael Saylor often draws a compelling analogy between Bitcoin and Manhattan real estate, elucidating its intrinsic value and growth potential.

Growth Potential:

Current Market Cap: $1.87 trillion.

21-Year Projection: $240 trillion (29% annual growth).

"Bitcoin's limited supply—capped at 21 million coins—makes it akin to prime real estate," Saylor compares. Unlike traditional property, Bitcoin offers unparalleled liquidity, divisibility, and portability, rendering it an attractive asset for both individuals and institutions.

As The Fool highlights:

"Bitcoin represents a paradigm shift in asset allocation."

And MarketWatch observes:

"We believe that Bitcoin is superior to bonds, stocks, and commodities like gold and silver due to its digital nature and hard supply cap."

"Bitcoin is Manhattan in cyberspace," Saylor proclaims, emphasizing its foundational role in the burgeoning digital economy.

5. Expanding the Investment Horizon: Other Bitcoin-Adopting Companies

MicroStrategy’s audacious Bitcoin strategy has catalyzed a wave of adoption across various enterprises, integrating Bitcoin into their financial architectures. Here are some noteworthy contenders:

Companies to Watch:

CleanSpark (CLSK): Diversifying its energy-focused business with Bitcoin.

Marathon Digital Holdings (MARA): Expanding mining operations to support Bitcoin infrastructure.

Genius Group (GNS): Acquired 110 BTC for $10 million to diversify its treasury.

Cosmos (COSM): Enhancing blockchain solutions with Bitcoin.

Riot Blockchain (RIOT): Scaling mining capabilities to capitalize on Bitcoin’s growth.

Liquid Group (LQR): Strengthening financial services with Bitcoin.

Meta Planet (META PLANET): Driving innovation in virtual spaces with Bitcoin adoption.

Strategic Impact:

"Bitcoin is the best investment asset," according to Wikipedia, and companies like MicroStrategy are substantiating this claim. Their adoption not only legitimizes digital assets in corporate finance but also fosters a competitive environment where digital innovation can flourish.

As Benzinga comments:

"MicroStrategy is the public equity play on Bitcoin maximalism."

This reflects a broader trend of corporations leveraging Bitcoin to enhance shareholder value and drive forward the digital economy.

6. The Bitcoin Reserve: Revolutionizing Digital Finance

One of the most groundbreaking propositions in digital finance is the establishment of a Bitcoin Reserve. This initiative aims to institutionalize Bitcoin within national financial frameworks, potentially revolutionizing how governments and large institutions manage digital assets.

Understanding the Bitcoin Reserve:

A Bitcoin Reserve entails allocating a significant portion of a nation's reserves to Bitcoin, analogous to how gold reserves function today. "Bitcoin is manifest destiny for the United States," Saylor fervently states, underscoring its strategic importance.

Senator Cynthia Lummis' Proposal:

Senator Cynthia Lummis, a staunch advocate for Bitcoin and cryptocurrency, has proposed selling a portion of the Federal Reserve's gold holdings to establish a Bitcoin Reserve. Her vision is to harness Bitcoin's digital nature to enhance financial resilience and modernization.

Proposal Highlights:

Funding Mechanism: Selling Federal Reserve gold to finance the purchase of Bitcoin.

Economic Implications: Diversifying national reserves with a digital asset that has a fixed supply.

Strategic Benefits: Enhancing the stability and global competitiveness of the national economy through digital asset integration.

Institutional Support and Momentum:

The Bitcoin Reserve concept has garnered significant attention and support from major financial institutions. BlackRock, the world's largest asset manager, has publicly endorsed the initiative, signaling robust institutional backing.

As Daily Hodl reports, Michael Saylor stated:

"We’re going to see a lot more pro-Bitcoin policies."

"When the Bitcoin Reserve goes into place, the US will own a substantial amount of Bitcoin, positioning itself and its companies as the largest holders of the cryptocurrency," Saylor confidently asserts.

Potential Benefits of a Bitcoin Reserve:

Diversification: Reduces dependency on traditional fiat currencies and precious metals.

Inflation Hedge: Bitcoin's limited supply makes it a robust hedge against inflation.

Technological Advancement: Promotes the adoption of blockchain technology.

Global Competitiveness: Positions the nation at the forefront of digital finance.

"The United States, by owning a significant portion of Bitcoin, will not only defend its Reserve currency status but also attract capital from around the globe," Saylor emphasizes.

Implications for MicroStrategy and the Broader Bitcoin Ecosystem:

A national Bitcoin Reserve would have profound implications for companies like MicroStrategy:

Increased Demand: Government adoption would likely escalate Bitcoin demand, enhancing its value and stability.

Legitimization: Institutional recognition solidifies Bitcoin's status as a legitimate asset.

Strategic Opportunities: MicroStrategy could leverage its expertise and holdings to shape and benefit from this new financial paradigm.

Stay attuned to reputable financial news outlets for the latest developments on the Bitcoin Reserve initiative.

7. Why I Believe in MicroStrategy: My Personal Perspective

Inspired by MicroStrategy’s strategic maneuvers, I have integrated MicroStrategy shares into my personal investment portfolio. This decision aligns with both my long-term Bitcoin investment objectives and my confidence in MicroStrategy's visionary approach.

Account 1:

Holdings: 0.0487 shares.

Average Price: $462.25 USD.

Total Value: $23.08 USD.

Performance: +2.50% all time.

Account 2:

Holdings: 0.0389 shares.

Average Price: $412.94 USD.

Total Value: $18.43 USD.

Performance: +14.75% all time.

Why MicroStrategy?

"Incorporating MicroStrategy into my portfolio isn't just about owning another tech stock—it's a strategic move aligned with my long-term Bitcoin investment goals," I reflect. By holding shares in a company that actively invests in Bitcoin, I’m poised to benefit from both the company's stock performance and the potential appreciation of Bitcoin. This dual approach not only diversifies my investments but also synchronizes with the envisioned future of digital assets in the global economy.

Basically, buying MicroStrategy is the same thing as buying Bitcoin, but it comes with more benefits. Watching Michael Saylor’s interview with Patrick Bet-David, he essentially explained that the main benefit is providing access to those who aren't able to explore Bitcoin due to regulatory restrictions. For example, in countries like the UK or South Korea, where recent laws prevent people from directly purchasing or holding Bitcoin in certain accounts, MicroStrategy offers a workaround. If you wanted Bitcoin exposure in your 401(k) or TFSA but couldn’t hold Bitcoin directly, buying MicroStrategy stock gives you that exposure.

Personally, I see it as a win-win. I’m essentially buying Bitcoin through MicroStrategy with added benefits, and I aim to accumulate both Bitcoin and MSTR whenever possible. Even as I’m writing this on November 21, 2024, Bitcoin is still surging, and it’s surreal to witness.

To answer another common question, "Why would I give my money to MicroStrategy to invest in Bitcoin instead of just buying Bitcoin directly?" The answer lies in MicroStrategy's unique advantages as a public company:

1. Access to Low-Cost Capital

MicroStrategy has a proven ability to borrow large amounts of money at exceptionally low interest rates. For instance, the company secured $4.2 billion in unsecured loans for five years at less than 1% interest. This is virtually impossible for individual investors to achieve, making MicroStrategy an efficient vehicle for leveraging capital to acquire Bitcoin.

Michael Saylor:

"Can you borrow a billion dollars for free for five years with no recourse and unsecured? Probably not. But companies like MicroStrategy can."

2. The Cheapest Cost of Capital in the Market

MicroStrategy likely has the lowest cost of capital in the market, even when compared to other S&P 500 companies. This financial efficiency allows the company to generate superior returns from its Bitcoin investments, directly benefiting its shareholders.

3. Regulatory Barriers in Certain Markets

In regions like the UK, regulations often prevent individuals or institutional investors from directly buying Bitcoin. Similarly, retirement plans, 401(k)s, and other investment vehicles may not permit direct cryptocurrency investments. However, these investors can purchase MicroStrategy stock, which offers indirect exposure to Bitcoin.

Michael Saylor:

"If you’re a UK investor and regulations don’t allow you to buy Bitcoin directly, you can still buy MicroStrategy stock."

4. Diversification and Flexibility

MicroStrategy offers multiple ways to gain exposure to Bitcoin, from equity shares to Bitcoin-backed bonds and convertible notes. This tiered approach allows investors to choose instruments tailored to their risk tolerance and return expectations, offering flexibility not possible with direct Bitcoin purchases.

Michael Saylor:

"When you invest with MicroStrategy, you’re not just getting Bitcoin. You’re getting the financial power of a company that can leverage Bitcoin like no one else."

5. Bridging Bitcoin and Traditional Finance

MicroStrategy bridges the gap between Bitcoin and traditional finance. By investing in the company, both institutional and retail investors gain exposure to Bitcoin through a regulated public entity, enabling participation in the growth of the digital asset economy.

Michael Saylor:

"For investors who can't buy Bitcoin directly due to regulations or limitations, MicroStrategy provides a compliant, efficient way to gain exposure."

The Bottom Line

MicroStrategy is more than a stock; it’s a gateway to Bitcoin, tailored for those who want exposure to this revolutionary asset while leveraging the financial infrastructure of a publicly traded company. Whether you’re an individual looking for a way around regulations or an institution seeking efficient capital use, MicroStrategy provides a compelling solution.

Personal Insights:

Risk Management: Diversifying my holdings between TFSA and non-registered accounts allows me to manage risk effectively while maximizing potential returns.

Long-Term Vision: Like the historic land deals discussed earlier, investing in MicroStrategy is about having faith in a long-term vision that transcends immediate market fluctuations.

Active Monitoring: Keeping a vigilant eye on both the company's performance and the broader Bitcoin market every single day ensures that my investment strategy remains informed and adaptable and I’m able to make any quick decisions if need be.

By sharing my portfolio, I aim to provide a relatable exemplar of how individuals can integrate innovative companies like MicroStrategy into their investment strategies, leveraging their unique positions in the evolving digital economy.

For personalized investment advice, always consult with a certified financial advisor.

8. Regulatory Hurdles and Government Initiatives

Embracing Bitcoin is not devoid of challenges. However, with the establishment of a Bitcoin Reserve, many of these challenges are mitigated, positioning Bitcoin as a cornerstone of national financial strategy.

Key Developments:

Senator Cynthia Lummis Proposal: Advocates selling Federal Reserve gold to fund a Bitcoin Reserve.

Newsweek Analysis: Scrutinizes the feasibility and economic ramifications of a national Bitcoin Reserve.

Forbes Insight: Highlights Bitcoin price surges linked to expectations of a U.S. Bitcoin Reserve.

Institutional Support:

BlackRock, a global investment behemoth, has endorsed the Bitcoin Reserve concept. This endorsement signifies a burgeoning alignment between private institutions and public policies in digital finance.

As Financial Times reports:

"We are actively pursuing bitcoin investments to capitalize on the expectation of a favorable regulatory environment for cryptocurrencies."

Regulatory Landscape:

With the Bitcoin Reserve firmly in place, regulatory frameworks are evolving to support the integration of Bitcoin into national reserves. "Establishing a Bitcoin Reserve requires comprehensive regulatory frameworks to ensure security, compliance, and stability," Saylor asserts. The proactive engagement of industry leaders like MicroStrategy is pivotal in shaping these regulatory landscapes.

"The Bitcoin Reserve will not only enhance the stability of our national economy but also attract foreign capital, positioning the United States as the epicenter of digital finance," Saylor confidently states.

Stay informed by following updates from regulatory bodies and trusted financial news sources.

9. Practical Lessons for Investors

Navigating the labyrinthine world of digital assets demands strategic acumen and informed decision-making. MicroStrategy’s odyssey with Bitcoin offers several quintessential lessons for discerning investors.

Key Takeaways:

Long-Term Holding:

"Bitcoin’s potential for substantial long-term gains makes it a compelling investment," Saylor underscores. For instance, an investment of $1,000 today could burgeon to $135,000 in 21 years at a 29% annual growth rate. This exemplifies the power of compounding returns and the advantages of holding scarce assets over extended periods.Leveraging Financial Tools:

Convertible bonds and other financial instruments present low-cost avenues for acquiring Bitcoin. "Convertible bonds allow us to secure substantial funds at favorable rates," Saylor explains. These tools empower investors to gain exposure to Bitcoin without necessitating a large upfront investment, offering flexibility and potential upside as Bitcoin’s value ascends.

MicroStrategy articulates:

"We plan to use the additional capital to buy more bitcoin as a treasury reserve asset in a manner that will allow us to achieve higher BTC Yield."

Furthermore:

"Our BTC Yield is 17.8% year-to-date 2024."Diversification Through Bitcoin:

"Integrating Bitcoin into investment portfolios enhances resilience and aligns with future economic trends," Saylor notes. Bitcoin’s unique attributes, such as decentralization and limited supply, confer diversification benefits that traditional assets may lack, thereby reducing overall portfolio risk and amplifying potential returns.

"Bitcoin is the most lucrative asset you can hold without the typical risks associated with traditional investments," Saylor emphasizes.

Strategic Insights:

Patience and Conviction: "If you're going to buy it, be prepared to hold it more than four years," Saylor emphasizes, advocating for a long-term investment horizon that transcends short-term market fluctuations.

Educational Imperative: Comprehensive education on Bitcoin's fundamentals is paramount. "We educate our officers and directors to form a consensus and drive forward our Bitcoin strategy," Saylor reveals, highlighting the importance of informed decision-making within corporate structures.

"The discipline of buy-and-hold is essential in harnessing Bitcoin's full potential," Saylor advises, underscoring the importance of conviction amidst market volatility.

Always conduct thorough research and consider consulting a financial advisor before making investment decisions.

10. Real-Time Market Highlights

(As of November 21, 2024. For the latest data, consult current financial platforms.)

Bitcoin (BTC):

Current Price: $97,046.63 (+3.06%).

Market Cap: $1.919 trillion.

24-Hour Price Range:

High: $94,999.00 USD.

Low: $91,625.00 USD.

MicroStrategy Inc. (MSTR):

Current Price: $473.83 USD (+10.04%).

Market Cap: $106.5 billion.

24-Hour Price Range:

High: $504.32 USD.

Low: $433.32 USD.

These metrics underscore the dynamic nature of the cryptocurrency and technology sectors. Bitcoin’s steady price ascent and MicroStrategy’s robust stock performance epitomize the positive sentiment surrounding digital assets and the strategic maneuvers of forward-thinking enterprises.

As Barron's reports on MicroStrategy:

"MicroStrategy unveiled an ambitious plan in October to raise $42 billion through stock and bond sales by 2027. The company is already well on its way, having sold approximately $5 billion in equity under the program, alongside a newly announced bond deal on Wednesday."

11. Conclusion: Sculpting the Digital Future

MicroStrategy’s strategy transcends the mere acquisition of Bitcoin; it signifies a fundamental metamorphosis in corporate finance by positioning Bitcoin as a transformative asset class. Drawing inspiration from historic acquisitions and propelled by contemporary financial innovations, Michael Saylor and MicroStrategy have demonstrated that audacious, forward-thinking strategies can redefine wealth creation and management paradigms.

"Bitcoin is the next frontier. Just like Manhattan in 1626, it's laying the foundation for a new era of economic empowerment," Saylor concludes.

Bitcoin, akin to Manhattan in 1626, is establishing the bedrock for a new epoch of economic empowerment. Its scarcity and burgeoning institutional adoption render it a cornerstone of the digital economy, presenting unparalleled opportunities for growth and value creation.

"When you invest in Bitcoin, you're not just investing in a digital asset; you're investing in the future of global capital," Saylor asserts, encapsulating the transformative potential of Bitcoin.

12. Author Insights and Future Predictions

I personally think from the data I’ve seen and from how recently I’ve learned about MicroStrategy is that it will 1000% be a trillion dollar company very soon. Their market cap is increasing and they can just sell their shares for cash and then buy more bitcoin personally. And as their market cap increases they are literally passing companies that have hundreds of billions of dollars and those companies can do nothing. Right now MicroStrategy is out performing Nvidia and they don’t even have any really big technology or huge investments or AI or anything its just bitcoin. Which to me is very crazy I think if you get in right now in 20+ years you will definitely see atleast 29% annual growth on your investments bare minimum.

For predictions I’ve seen predictions that say MSTR 0.00%↑ will be $1000 early January 2025

Source:https://x.com/TaylorK88114500/status/1858934320955879551

Or other have said $MSTR will be $700 per share by the end of December 2024

Source: https://x.com/PolarisCUDA/status/1859359688489566301?t=ZCchGtM1AfhehYRXNzcI5Q&s=19

For bitcoin according to @ali_charts on X they have predictions for #BTC to reach about $225,000 in 2025

Source:https://x.com/ali_charts/status/1856710863023190231?t=AW2rTmvwMcWrCOnJCSP3LQ&s=19

I’ve definitely seen some predictions though for bitcoin to gradually hit like 100k by the end of 2024 for sure. And then for the Q1 of 2025 it could gradually go from 100k to 125K then to 150K. My prediction is that it will definitely hit 200k by the end of 2025 especially if the US does the Bitcoin Reserve and if the Top S&P 500 countries buy billions of dollars of bitcoin for their balance sheets and get rid of all the cash they have I can see bitcoin definitely skyrocketing but the average person will be left in the dust if they dont act quick. Right now as I’m writing this at November 21, 2024 @ 12:52am MST Bitcoin has an all time high of $97,862.64 and MSTR 0.00%↑ is performing well also.

My suggestion to everyone is to do your research and learn as much information as possible. There's no point running and buying anything if you don’t understand what you are buying. You need to have the knowledge first otherwise you’ll make dumb mistakes. So go and learn bitcoin and what MicroStrategy is doing on your own and then come to your own conclusion. And hopefully your decision benefits you in the long run.

ZRT

Subscribe to me here for more

and Follow me on X https://x.com/ZRT_219Useful MSTR Links+Sources

MicroStrategy's Michael Saylor: Bitcoin To $13M? MicroStrategy's $4B Bitcoin Bet | PBD Podcast | 508

NAV Multiple:

Quant Bros Podcast:

https://www.youtube.com/@Quant_Bros

MSTR Calculator:

MSTR Catalysts:

MSTR Stock Screener:

https://finviz.com/quote.ashx?t=MSTR&p=d

MSTR BTC Purchases:

MSTR BTC Treasury:

https://treasuries.bitbo.io/microstrategy/

MSTR/BTC Comparison:

https://portfolioslab.com/tools/stock-comparison/MSTR/BTC-USD

MSTR Institutional Activity:

https://hedgefollow.com/stocks/MSTR

BTC Tools:

https://www.lopp.net/bitcoin-information.html