XRP: The Digital Asset Revolutionizing Global Finance

From Technology to Regulation: A Comprehensive Analysis of XRP and its Ecosystem

By ZRT

Table of Contents

Introduction: The Digital Finance Revolution is Here

Chapter 1: XRP: Utility in a Digital Age – Beyond the Security Debate (with Historical Price Analysis)

Chapter 2: Utility Over Hype: Why Real-World Application Matters More Than Market Cap

Chapter 3: Navigating the Crypto Landscape: XRP's Position and Market Dynamics

Chapter 4: XRP vs. Bitcoin: Distinct Roles in the Crypto Ecosystem

Chapter 5: XRP: A Catalyst for Modernizing Global Finance

Chapter 6: Digital Assets as Stabilizers: XRP and Financial Crisis Mitigation

Chapter 7: The XRP Ledger (XRPL): Powering the Future of Transactions

Chapter 8: Ripple USD (RLUSD): Bridging the Gap Between Fiat and Crypto on XRPL

Chapter 9: Strategic Partnerships: Building the Ripple Ecosystem Globally

Chapter 10: Bitcoin: The Pioneering Store of Value (Origins and Current Role)

Chapter 11: XLM: Stellar – A Network with Shared Vision, Different Focus (A Close Cousin)

Chapter 12: The Evolving Regulatory Landscape: Charting a Course for Digital Assets

Chapter 13: Hedera Hashgraph and HBAR: Exploring Alternative Distributed Ledger Technologies

Chapter 14: Ripple Liquidity Hub and Enterprise Solutions: Expanding Adoption

Chapter 15: Future Prospects and Price Potential: Navigating Growth and Expectations (Including XRP ETFs)

Chapter 16: Crypto Trading and Investment Considerations: A Balanced Perspective

Chapter 17: RLUSD Market Cap and Volume: A Deeper Dive into the Stablecoin's Performance

Conclusion: XRP and the Dawn of a New Financial Era

Introduction: The Digital Finance Revolution is Here

We are in the midst of a profound financial transformation. Digital assets are not merely a technological novelty; they represent a fundamental shift in how we create, transfer, and manage value globally. XRP, a digital asset designed with a core focus on utility, and the ecosystem fostered by Ripple, are at the forefront of this revolution.

This updated article delves into the world of XRP, exploring its unique attributes, its role in reshaping global finance, and the introduction of Ripple USD (RLUSD), a stablecoin designed to bridge the traditional financial world with the rapidly expanding digital economy. We'll move beyond market speculation to examine the real-world applications driving XRP's value, analyze its position within the broader cryptocurrency landscape, and consider the evolving regulatory environment that is shaping the future of digital assets. We will also analyze XRP's historical price performance to understand its present market position.

This is not just about price charts and hype. This is about understanding the potential of digital assets like XRP to create a more efficient, inclusive, and interconnected financial system for everyone. Welcome to the digital finance revolution.

Chapter 1: XRP: Utility in a Digital Age – Beyond the Security Debate (with Historical Price Analysis)

The conversation surrounding XRP has often been dominated by regulatory classifications, particularly the debate about whether it should be categorized as a security. While regulatory clarity is undoubtedly crucial, it's essential to look beyond this debate and understand the fundamental utility that XRP brings to the digital age, as well as how its price has performed historically.

XRP: More Than Just a Token – A Utility Asset

The core argument for XRP as a utility asset rests on its practical applications:

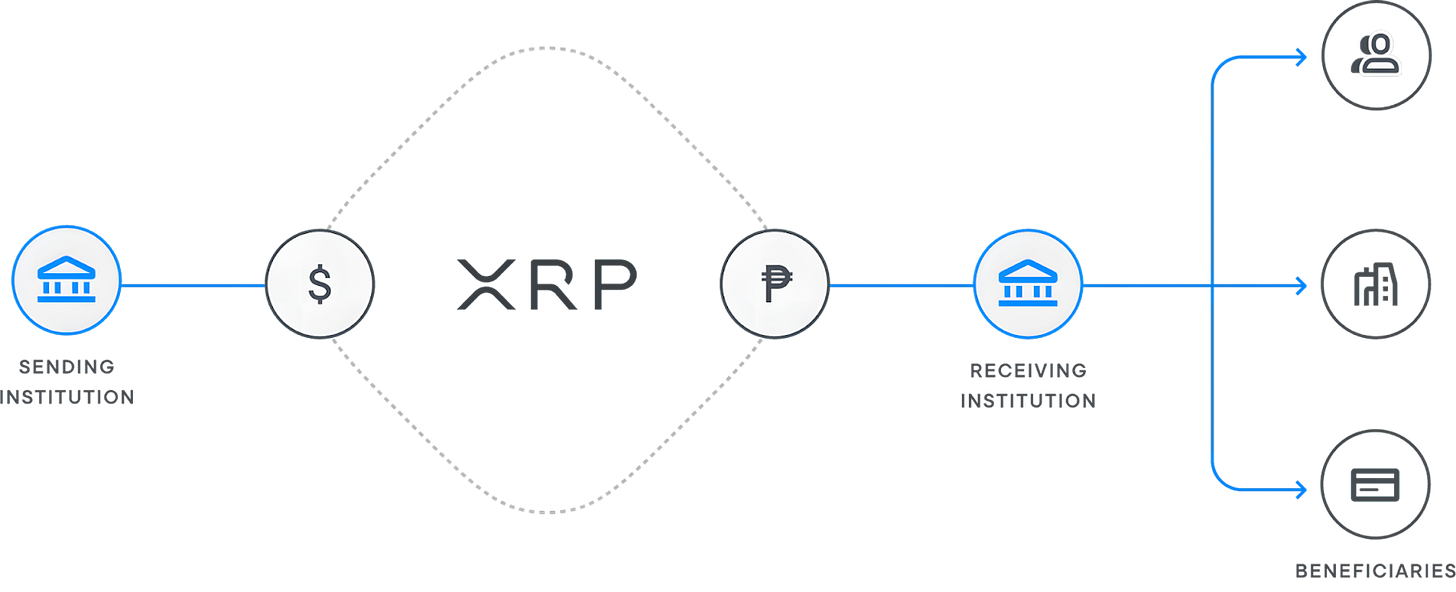

Cross-Border Payments and On-Demand Liquidity (ODL): Ripple’s ODL solution leverages XRP as a bridge currency to expedite international money transfers. Traditional systems rely on correspondent banking, a slow and costly network. ODL, powered by XRP, eliminates the need for pre-funded accounts (nostro/vostro accounts), reducing costs and settlement times dramatically.

Microtransactions and Low-Cost Transfers: The XRP Ledger (XRPL), the underlying blockchain for XRP, boasts incredibly low transaction fees – fractions of a cent. This makes XRP ideal for microtransactions and remittances, especially in regions where high fees disproportionately impact users.

Decentralized Exchange (DEX) and DeFi Potential: The XRPL includes a built-in DEX, enabling the seamless exchange of various assets. While DeFi on XRPL is still developing compared to ecosystems like Ethereum, XRP's low-cost and fast transactions make it a promising contender for future DeFi growth.

Tokenization and Asset Transfer: The XRPL is designed to facilitate the tokenization of various assets – from real estate and commodities to currencies and even digital identities. XRP acts as a native asset within this ecosystem, enabling efficient transfer and exchange.

Navigating the Regulatory Landscape – The Security Question

The regulatory debate, particularly in the United States, has centered around whether XRP constitutes a security under the Howey Test, a legal framework used to determine if an asset is an investment contract and thus a security. The Howey Test examines:

Investment of Money: Was there an investment of money?

Common Enterprise: Is there a common enterprise?

Expectation of Profits: Is there an expectation of profits?

Efforts of Others: Are profits primarily derived from the efforts of others?

Ripple Labs has consistently argued that XRP, particularly when sold on secondary markets, does not meet the criteria to be classified as a security. Key arguments include:

Utility Focus: XRP’s primary purpose is utility in payments and liquidity solutions, not solely speculative investment.

Decentralized Nature: XRP transactions are decentralized, and the XRPL operates independently of Ripple Labs to a significant degree.

Market-Driven Value: XRP's price is influenced by broader market forces, supply and demand, and adoption, not solely by the efforts of Ripple Labs.

Recent Legal Developments and Ongoing Clarity

Recent legal developments in the US have provided partial clarity. A court ruling indicated that programmatic sales of XRP on exchanges are not considered securities transactions. However, direct sales to institutional investors were deemed to potentially fall under securities regulations. This is a complex and evolving legal situation, with potential for appeals and further clarification.

Global Regulatory Perspectives

It's crucial to note that regulatory perspectives vary globally. Jurisdictions like Japan have classified XRP as a cryptocurrency, facilitating its integration into financial systems. The European Union's MiCA framework is also shaping the regulatory landscape for digital assets in Europe, potentially offering a clearer path for XRP in the EU.

XRP Historical Price Analysis: A Look Back to Understand the Present

Understanding XRP's price history is essential for grasping its current market position and potential future trajectory.

Key Historical Price Periods (Data Source: CoinMarketCap - Historical Snapshots):

Early Days (2013-2016): XRP traded at fractions of a cent for several years, with limited trading volume. This period reflected the early stages of development and adoption.

2017 Bull Run: Like many cryptocurrencies, XRP experienced a meteoric rise in 2017, reaching an all-time high of around $3.84 in January 2018. This surge was driven by a combination of factors, including increased interest in cryptocurrencies, growing awareness of Ripple's technology, and speculative trading.

Post-2017 Correction (2018-2020): Following the 2017 peak, XRP entered a prolonged bear market, along with the broader crypto market. Prices declined significantly, and XRP traded below $0.50 for much of this period. This period was also marked by increasing regulatory scrutiny.

SEC Lawsuit and its Impact (December 2020 - Present): The SEC's lawsuit against Ripple Labs in December 2020, alleging that XRP was an unregistered security, had a significant negative impact on XRP's price. Many exchanges delisted or suspended XRP trading, particularly in the US.

Partial Legal Clarity and Recent Price Action (2023): The partial court ruling in July 2023, stating that programmatic sales of XRP on exchanges are not securities transactions, provided a boost to XRP's price. However, the price remains significantly below its all-time high, and ongoing legal proceedings continue to influence market sentiment.

Example Historical Price Data (Illustrative - Using Approximate Figures from CoinMarketCap):

Note: These figures are approximate and for illustrative purposes. Always refer to a reliable source like CoinMarketCap for precise historical data.

Analyzing the Price History:

Volatility: XRP's price history demonstrates the extreme volatility inherent in the cryptocurrency market. Prices have experienced dramatic swings, both upward and downward.

Impact of Market Cycles: XRP's price has been influenced by broader cryptocurrency market cycles, including the 2017 bull run and subsequent bear market.

Regulatory Influence: Regulatory news and legal developments have had a significant impact on XRP's price, particularly the SEC lawsuit.

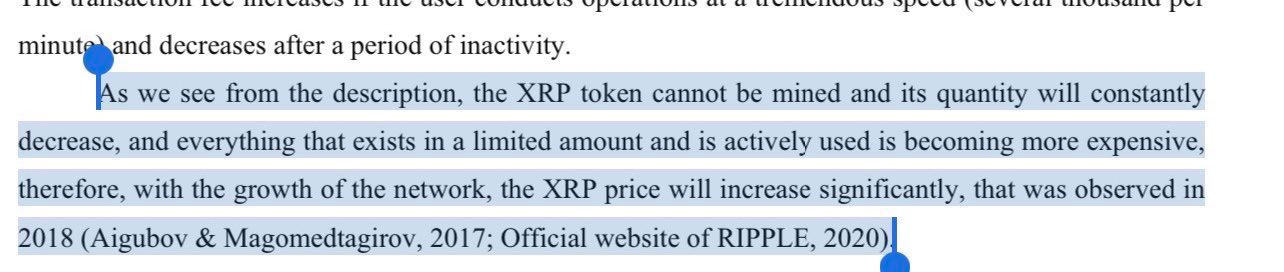

Utility vs. Speculation: While speculative trading has undoubtedly played a role in XRP's price movements, its underlying utility in cross-border payments and growing adoption by financial institutions provide a foundation for long-term value.

Beyond the Label: Focusing on Utility and Adoption

Regardless of the ongoing regulatory nuances, the core strength of XRP lies in its utility. As adoption grows, driven by real-world applications in payments, remittances, DeFi, and tokenization, the intrinsic value of XRP as a utility asset is likely to become increasingly evident. The focus should shift towards fostering this utility and expanding its reach, paving the way for a more efficient and accessible financial future. The historical price data, while showing volatility, also reveals the potential for significant growth when utility and adoption align with positive market conditions and regulatory clarity.

Chapter 2: Utility Over Hype: Why Real-World Application Matters More Than Market Cap

In the often-frenzied world of cryptocurrencies, market capitalization (market cap) is frequently touted as the ultimate metric of success. While market cap reflects the total perceived value of a digital asset at a given moment, it's crucial to recognize its limitations and understand why utility – real-world application – holds greater long-term significance.

The Market Cap Illusion: Speculation vs. Substance

Market cap is calculated by multiplying the circulating supply of a cryptocurrency by its current price. This formula, while seemingly straightforward, can be heavily influenced by:

Speculation and Hype: Assets with limited or no real-world utility can experience dramatic price surges and inflated market caps purely based on speculative trading and social media hype. Meme coins are a prime example.

Market Sentiment and Volatility: The cryptocurrency market is notoriously volatile. Market cap can fluctuate wildly based on news cycles, social media trends, and overall market sentiment, often disconnected from fundamental utility.

Tokenomics and Supply Dynamics: Cryptocurrencies with artificially restricted supplies or complex tokenomics can create scarcity and inflate prices, leading to higher market caps that don't necessarily reflect real-world usage.

XRP: Building Value on a Foundation of Utility

In contrast to assets driven primarily by hype, XRP's value proposition is rooted in its utility. This utility translates into tangible benefits for users, businesses, and the financial system as a whole:

Cost Savings and Efficiency in Payments: ODL, powered by XRP, demonstrably reduces transaction costs and settlement times for cross-border payments. This is not theoretical; financial institutions and payment providers using Ripple's technology report significant savings and efficiency gains.

Financial Inclusion and Accessibility: XRP's low transaction fees make financial services more accessible to underserved populations, enabling remittances, microtransactions, and participation in the digital economy for those previously excluded due to high costs.

Real-World Adoption and Partnerships: Ripple's strategic partnerships with financial institutions and payment providers are driving real-world adoption of XRP. This isn't just about theoretical potential; it's about tangible integrations and increasing transaction volumes in practical applications.

Sustainable Value Growth: Utility-driven assets are more likely to experience sustainable value growth over the long term. While speculation can drive short-term price spikes, real-world utility builds a foundation for consistent demand and long-term appreciation.

Comparing Utility Across Cryptocurrencies

When comparing cryptocurrencies, it's essential to look beyond market cap and assess their underlying utility:

Projecting Value Based on Utility Growth

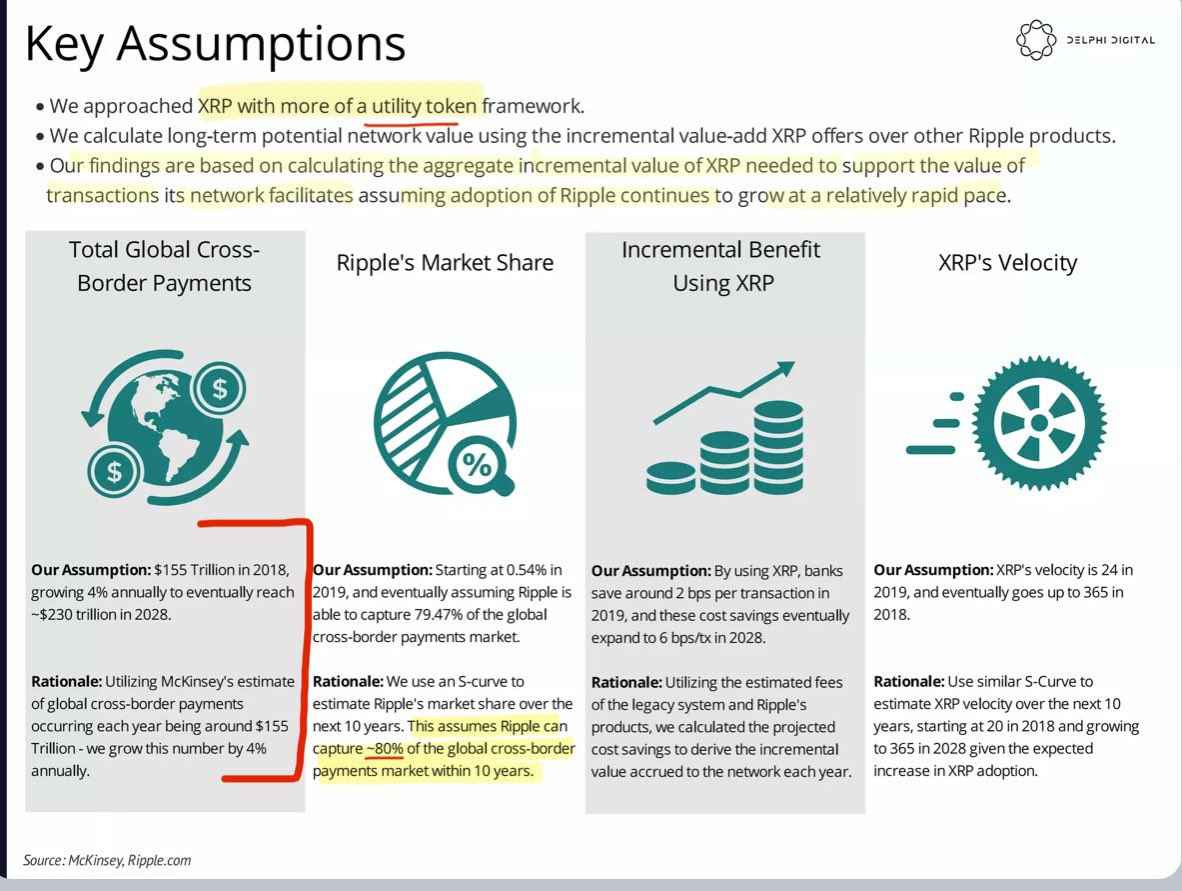

While predicting future market caps is speculative, we can project potential value growth based on the expansion of XRP's utility:

Increased ODL Adoption: As more financial institutions and payment providers adopt ODL, transaction volumes and demand for XRP are likely to increase.

Growth of XRPL Ecosystem: Expansion of DeFi, tokenization, and other applications on the XRPL will further drive utility and demand for XRP as the native asset of the ledger.

Financial Inclusion Impact: As XRP facilitates more affordable financial services in developing economies, its societal impact and user base will grow, potentially increasing its long-term value.

Conclusion: Utility as the True Measure of Success

While market cap provides a snapshot of current perceived value, it's utility that ultimately determines the long-term success and sustainability of a digital asset. XRP's focus on real-world applications, its demonstrable efficiency in payments, and its potential to drive financial inclusion position it as a valuable asset in the evolving digital economy. In the long run, utility will likely prove to be a far more reliable indicator of value than fleeting market hype.

Chapter 3: Navigating the Crypto Landscape: XRP's Position and Market Dynamics

The cryptocurrency market is a dynamic and ever-shifting ecosystem. Understanding XRP's position within this landscape requires more than just tracking market cap rankings; it involves analyzing its unique role, its relationship with other key assets, and the broader market forces that influence its trajectory.

Beyond Market Cap Rankings: A Holistic View

While XRP has often been positioned among the top cryptocurrencies by market cap, these rankings are not static and can fluctuate significantly. Focusing solely on market cap rankings can be misleading. A more insightful approach involves considering:

XRP's Unique Value Proposition: As discussed, XRP's core value lies in its utility for payments and liquidity. This distinct focus differentiates it from assets like Bitcoin (primarily store of value) and Ethereum (platform for dApps).

Adoption and Real-World Use Cases: Tracking the growth of ODL corridors, partnerships with financial institutions, and the development of applications on the XRPL provides a more tangible measure of XRP's progress and potential.

Market Sentiment and Narrative: Cryptocurrency markets are heavily influenced by sentiment and prevailing narratives. Understanding the market's perception of XRP, its strengths, and its challenges is crucial.

Regulatory Developments: Regulatory news and clarity (or uncertainty) are significant drivers of market dynamics for all cryptocurrencies, and XRP is particularly sensitive to these developments given its history.

XRP in Relation to Key Crypto Assets

XRP vs. Bitcoin (BTC): While both are prominent cryptocurrencies, they serve distinct purposes. Bitcoin is primarily viewed as "digital gold," a store of value. XRP is designed for utility in payments and liquidity. Their price movements can sometimes be correlated due to overall market trends, but their underlying value drivers are different. (This comparison is explored in detail in Chapter 4).

XRP vs. Ethereum (ETH): Ethereum is the leading platform for smart contracts and decentralized applications (dApps). XRP's smart contract capabilities are evolving, but Ethereum remains the dominant platform for DeFi and dApp development. However, XRP's low transaction costs and speed could make it competitive in certain DeFi applications in the future.

XRP vs. Stablecoins (e.g., USDT, USDC): Stablecoins like Tether (USDT) and USD Coin (USDC) are pegged to fiat currencies, primarily used for trading within the crypto ecosystem and as a safe haven during market volatility. XRP is not a stablecoin; its price fluctuates based on market forces. However, Ripple has now launched RLUSD (Ripple USD), a stablecoin on XRPL, to bridge the gap between fiat and crypto and enhance utility within the XRP ecosystem. (RLUSD is explored in detail in Chapter 8).

Market Dynamics Influencing XRP

Overall Cryptocurrency Market Trends: XRP's price is influenced by the broader cryptocurrency market cycles. Bull markets tend to lift most assets, while bear markets can lead to price declines across the board.

Regulatory News and Clarity: As mentioned, regulatory developments, particularly in major jurisdictions, have a significant impact on XRP's market sentiment. Positive regulatory news can boost prices, while negative news or uncertainty can lead to price drops.

Adoption Milestones and Partnerships: Announcements of new partnerships, expansions of ODL corridors, and progress in real-world adoption can positively influence market perception of XRP's value.

Technological Developments and XRPL Ecosystem Growth: Advancements in XRPL technology, the growth of DeFi and tokenization applications on XRPL, and overall ecosystem development can contribute to long-term value appreciation.

Market Sentiment and Social Media: Social media trends and online discussions can influence short-term price movements, although these are often driven by speculation and hype rather than fundamental utility.

Navigating Market Volatility and Informed Decision-Making

The cryptocurrency market is inherently volatile. Understanding market dynamics is crucial for informed decision-making, but it's essential to:

Focus on Fundamentals: Prioritize understanding the underlying utility of XRP, its real-world applications, and the long-term vision.

Be Aware of Market Sentiment but Don't Be Ruled by Hype: Pay attention to market sentiment and narratives, but avoid making investment decisions solely based on short-term hype or fear.

Stay Informed about Regulatory Developments: Keep abreast of regulatory news and clarity in key jurisdictions, as these developments can significantly impact market dynamics.

Practice Risk Management: Cryptocurrency investments are high-risk. Only invest what you can afford to lose, and diversify your portfolio.

Conclusion: XRP's Position in a Complex Ecosystem

XRP occupies a unique position within the cryptocurrency landscape, driven by its utility-focused design. Its market dynamics are influenced by a complex interplay of factors – from overall market trends and regulatory news to adoption milestones and market sentiment. Navigating this landscape requires a holistic understanding of XRP's value proposition, a focus on fundamentals, and a realistic approach to the inherent volatility of the cryptocurrency market.

Chapter 4: XRP vs. Bitcoin: Distinct Roles in the Crypto Ecosystem

Bitcoin and XRP are often mentioned in the same breath as leading cryptocurrencies, but beneath the surface, they represent fundamentally different approaches to digital assets and serve distinct roles within the evolving crypto ecosystem. Understanding these differences is crucial for appreciating their individual strengths and potential.

Bitcoin: The Pioneering Store of Value

Bitcoin, the first cryptocurrency, emerged in 2009 as a revolutionary concept: decentralized digital cash. Over time, however, its primary narrative has shifted towards becoming a "store of value," often compared to "digital gold."

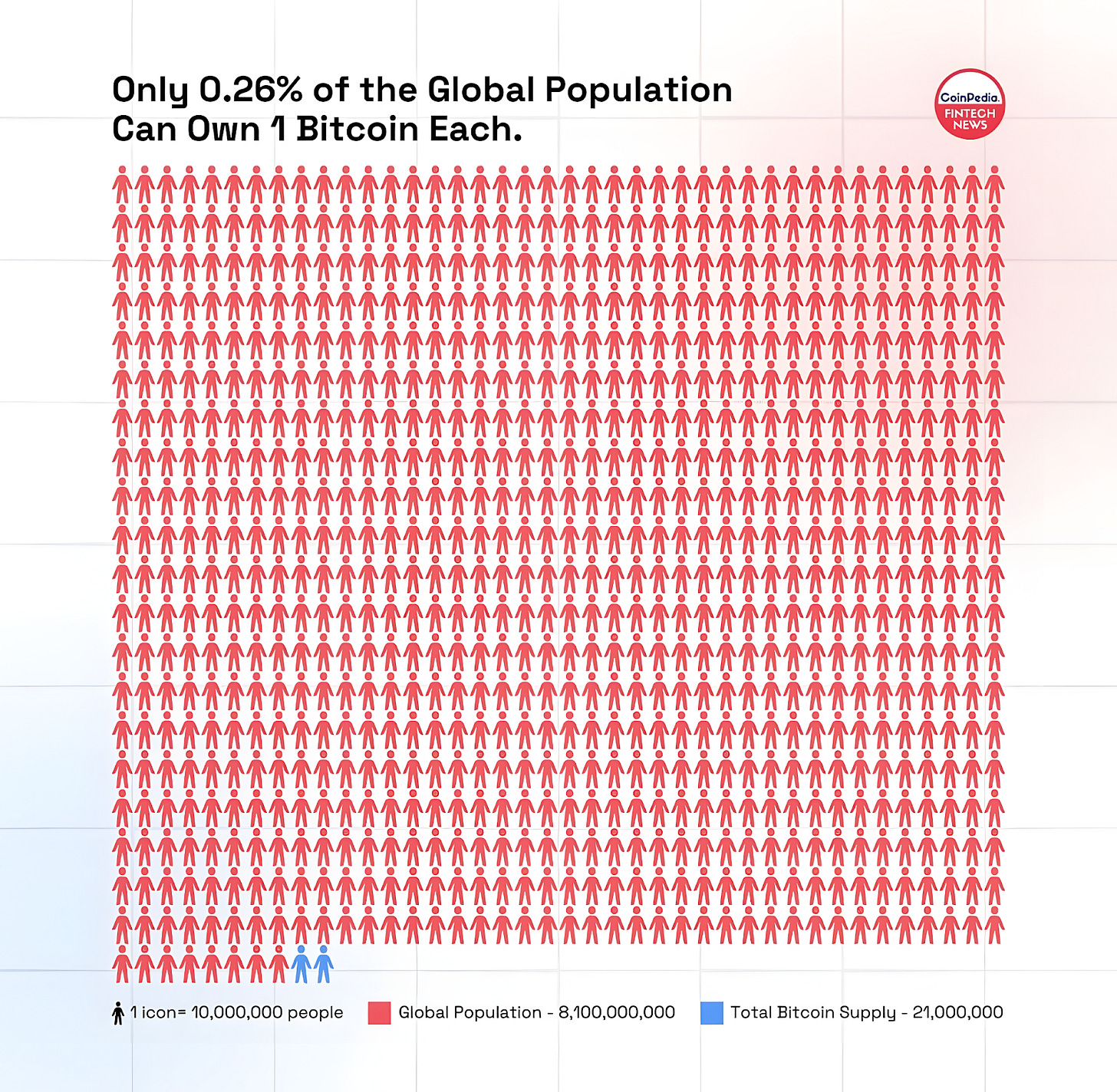

Genesis and Design: Created as a peer-to-peer electronic cash system, Bitcoin's design emphasizes decentralization, censorship resistance, and a fixed supply of 21 million coins.

Consensus Mechanism: Proof-of-Work (PoW): Bitcoin utilizes PoW, a computationally intensive process where miners solve complex puzzles to validate transactions and secure the network. While secure, PoW is energy-intensive and contributes to slower transaction speeds.

Transaction Speed and Cost: Bitcoin's transaction speed is relatively slow (averaging 10-60 minutes for confirmation), and transaction costs can vary and sometimes be high, especially during periods of network congestion.

Primary Use Case: Store of Value: Bitcoin's limited supply, decentralization, and established brand recognition have led to its adoption as a store of value, a hedge against inflation, and a long-term investment asset. Institutional interest in Bitcoin as a store of value has grown significantly.

Secondary Use Cases: While primarily a store of value, Bitcoin is also used for some peer-to-peer transactions and as a medium of exchange in certain contexts, although its scalability and cost limitations hinder its widespread use for everyday payments.

XRP: Utility and Efficiency for Global Finance

XRP, introduced by Ripple Labs in 2012, was designed to address specific inefficiencies in the traditional financial system, particularly in cross-border payments. Its focus is on utility, speed, and cost-effectiveness.

Genesis and Design: XRP was created to facilitate faster, cheaper, and more efficient international money transfers, targeting the inefficiencies of correspondent banking.

Consensus Mechanism: XRP Ledger Consensus Protocol: The XRPL utilizes a unique consensus protocol that does not rely on energy-intensive mining. Validators confirm transactions in seconds, ensuring high-speed settlements. This protocol is significantly more energy-efficient than Proof-of-Work.

Transaction Speed and Cost: XRP boasts incredibly fast transaction speeds (seconds for settlement) and extremely low transaction costs (fractions of a cent). This makes it ideal for high-frequency, low-value transactions and cross-border payments.

Primary Use Case: Payments and Liquidity: XRP's primary utility is as a bridge currency for cross-border payments and as a liquidity tool for financial institutions. Ripple's ODL solution leverages XRP to streamline international money transfers.

Emerging Use Cases: Beyond payments, XRP is exploring use cases in Decentralized Finance (DeFi), tokenization, and Central Bank Digital Currencies (CBDCs), leveraging the XRPL's capabilities.

Comparative Analysis: Bitcoin vs. XRP

Complementary Roles in the Crypto Ecosystem

Bitcoin and XRP, despite their differences, can be seen as complementary assets within the broader cryptocurrency ecosystem.

Bitcoin as the Foundation: Bitcoin's pioneering role and store-of-value narrative provide a foundational layer for the crypto market, attracting institutional interest and establishing the legitimacy of digital assets.

XRP as the Utility Layer: XRP addresses specific challenges in global finance, offering efficient payment solutions and liquidity tools. It can be seen as building upon the foundation laid by Bitcoin, focusing on practical applications.

Challenges and Opportunities

Bitcoin's Challenges: Scalability and energy consumption remain challenges for Bitcoin's broader adoption in everyday transactions. Layer 2 solutions like the Lightning Network are being developed to address scalability.

XRP's Opportunities: XRP's opportunities lie in continued adoption by financial institutions for cross-border payments, expansion into DeFi and CBDC applications, and navigating the regulatory landscape to achieve greater clarity and broader market access.

Conclusion: Distinct Assets, Shared Vision of a Digital Future

Bitcoin and XRP, while distinct in their design and primary use cases, both contribute to the broader vision of a digital future for finance. Bitcoin, as digital gold, provides a store of value and a gateway to the crypto world. XRP, with its utility-driven approach, offers practical solutions for payments and liquidity, pushing the boundaries of financial efficiency. As the cryptocurrency market matures, both assets are likely to coexist, serving different but valuable roles in the evolving global economy.

Chapter 5: XRP: A Catalyst for Modernizing Global Finance

The traditional financial system, while foundational to global commerce, is not without its inefficiencies and limitations. Cross-border payments, remittances, and liquidity management, in particular, suffer from outdated processes, high costs, and slow settlement times. XRP, with its unique capabilities, is positioned to be a catalyst for modernizing these critical aspects of global finance.

Addressing Inefficiencies in Traditional Finance

High Costs of Cross-Border Payments: Traditional cross-border payments often involve multiple intermediary banks, each adding fees and increasing the overall cost. Remittance fees can be particularly burdensome, especially for low-income individuals sending money home.

Slow Settlement Times: Cross-border transactions can take days to settle, due to the complexities of correspondent banking and varying banking hours across time zones. This delay impacts businesses needing real-time liquidity and individuals relying on timely remittances.

Lack of Transparency and Traceability: Traditional payment systems often lack transparency, making it difficult to track transactions in real-time and understand the various fees involved.

Liquidity Challenges and Tied-Up Capital: Financial institutions hold vast sums of capital in pre-funded accounts (nostro/vostro accounts) to facilitate cross-border payments. This capital is essentially locked up and cannot be used for other productive purposes.

XRP's Solutions for a Modern Financial System

XRP, through Ripple's technology and the XRPL, offers solutions to these challenges:

On-Demand Liquidity (ODL) for Cost-Effective Payments: ODL leverages XRP as a bridge currency, eliminating the need for pre-funded nostro/vostro accounts. This significantly reduces costs associated with cross-border payments, as financial institutions can source liquidity on demand using XRP.

Near-Instant Settlement Times: XRP transactions settle in seconds, drastically reducing settlement times compared to the days-long process of traditional systems. This speed enhances efficiency for businesses and ensures faster access to funds for individuals.

Increased Transparency and Traceability: The XRPL provides a transparent and immutable record of transactions. While privacy features can be implemented, the underlying ledger offers greater transparency compared to opaque traditional systems.

Efficient Liquidity Management: By eliminating the need for pre-funded accounts, ODL frees up significant capital for financial institutions, allowing them to deploy these funds more productively.

Real-World Adoption and Impact

Financial Institutions Utilizing RippleNet and ODL: Numerous banks and payment providers globally have integrated RippleNet and ODL into their systems, reporting significant cost savings and efficiency gains in cross-border payments. Examples include institutions in Europe, Asia, and Latin America.

Expansion of ODL Corridors: Ripple continues to expand ODL corridors, connecting more countries and currencies, and increasing the reach and impact of XRP-powered payment solutions.

Impact on Remittance Markets: XRP has the potential to significantly disrupt the remittance market, offering lower fees and faster transfers for migrant workers and individuals sending money across borders. This can have a profound impact on financial inclusion and economic empowerment in developing economies.

Exploring New Use Cases: Financial institutions are exploring additional use cases for XRP and the XRPL beyond cross-border payments, including internal settlements, tokenized asset transfers, and potential integration with CBDCs.

Challenges and Continued Progress

While XRP is making significant strides in modernizing finance, challenges remain:

Regulatory Hurdles: Navigating the complex and evolving regulatory landscape for digital assets is an ongoing challenge. Regulatory clarity is crucial for broader institutional adoption.

Competition from Existing Systems: Traditional financial systems, while inefficient, are deeply entrenched. Overcoming inertia and convincing institutions to adopt new technologies requires continued effort and demonstration of clear benefits.

Market Volatility and Perception: The inherent volatility of the cryptocurrency market and lingering perceptions of risk can sometimes hinder broader adoption by risk-averse institutions.

Despite these challenges, the progress made by XRP and Ripple in modernizing global finance is undeniable. As adoption continues to grow and regulatory clarity evolves, XRP is poised to play an increasingly important role in creating a more efficient, inclusive, and interconnected financial system for the future.

Chapter 6: Digital Assets as Stabilizers: XRP and Financial Crisis Mitigation

Financial crises, from currency devaluations to global liquidity crunches, have devastating consequences for individuals, businesses, and economies. While no single technology can prevent all crises, digital assets like XRP offer unique capabilities that can potentially mitigate the impact of future financial shocks and enhance the resilience of the global financial system.

Understanding the Vulnerabilities Exposed by Financial Crises

Liquidity Crises and Credit Freezes: During financial crises, trust erodes, and banks often hoard liquidity, leading to credit freezes and a contraction of economic activity. This was evident in the 2008 financial crisis.

Currency Devaluations and Hyperinflation: In countries experiencing economic instability, currency devaluations and hyperinflation can erode savings, disrupt trade, and create widespread economic hardship. Examples include hyperinflation in Zimbabwe and Venezuela.

Inefficient Payment Systems and Delays: In times of crisis, slow and inefficient payment systems can exacerbate problems, delaying access to funds and hindering economic recovery.

Over-Reliance on Centralized Institutions: Financial crises often highlight the risks of over-reliance on centralized institutions. Failures or disruptions in these institutions can have systemic consequences.

XRP's Potential Role in Mitigating Financial Crises

XRP, with its speed, low cost, and decentralized nature, offers several potential benefits in mitigating financial crises:

Instant Liquidity and Reduced Liquidity Risk: ODL, powered by XRP, enables financial institutions to access liquidity on demand, reducing the need to hold large reserves of capital in pre-funded accounts. This can help prevent liquidity crunches during crises, as institutions can more readily source funds when needed.

Faster and More Resilient Payment Flows: XRP's near-instant settlement times ensure faster payment flows, even during periods of market stress. The decentralized nature of the XRPL enhances resilience, reducing reliance on single points of failure in centralized payment systems.

Alternative to Unstable Currencies: In countries experiencing currency devaluations or hyperinflation, XRP can serve as an alternative intermediary asset for cross-border transactions, allowing individuals and businesses to transact in more stable currencies or assets.

Enhanced Financial Inclusion During Crises: XRP's low transaction fees make it a viable option for remittances and microtransactions, even during economic downturns. This can provide a lifeline for vulnerable populations who rely on these financial flows.

Increased Transparency and Accountability: The transparent nature of the XRPL can enhance accountability in financial transactions, potentially reducing opacity and risks associated with traditional systems, although privacy features can also be implemented.

Examples and Potential Impact

Currency Crises and Hyperinflation: In countries facing currency crises, XRP could facilitate remittances and cross-border payments, allowing individuals to access more stable currencies and preserve value.

Liquidity Crises: During a global liquidity crunch, ODL could help ensure that financial institutions have access to liquidity, preventing credit freezes and supporting continued economic activity.

Natural Disasters and Humanitarian Aid: XRP's speed and low cost could be beneficial for disbursing humanitarian aid quickly and efficiently in disaster-stricken areas.

Challenges and Considerations

It's important to acknowledge that XRP is not a panacea for financial crises. Challenges and considerations include:

Regulatory Acceptance and Adoption: Broader adoption of XRP by financial institutions and regulatory acceptance are crucial for realizing its full potential in crisis mitigation.

Market Volatility: While XRP can offer stability relative to some local currencies during crises, it is still subject to market volatility, which could be a concern for risk-averse institutions and individuals.

Scalability and Infrastructure: While the XRPL is highly scalable, ensuring sufficient infrastructure and adoption to handle large-scale crisis scenarios requires continued development.

Systemic Risks: Unintended consequences and systemic risks associated with widespread adoption of any new technology need to be carefully considered and managed.

Conclusion: Digital Assets as Tools for Resilience

Digital assets like XRP offer promising tools for enhancing the resilience of the global financial system and mitigating the impact of future financial crises. Their speed, low cost, decentralized nature, and potential for instant liquidity can address vulnerabilities exposed by past crises. While challenges remain, the potential of XRP to contribute to a more stable and robust financial future is significant, particularly in an increasingly interconnected and volatile world.

Chapter 7: The XRP Ledger (XRPL): Powering the Future of Transactions

The XRP Ledger (XRPL) is the underlying technology that powers XRP and enables its unique capabilities. It's a decentralized, public blockchain designed for speed, efficiency, and scalability, making it a strong contender for powering the future of transactions across various industries.

Technical Architecture and Key Features

Consensus Protocol: Unlike Bitcoin's Proof-of-Work, the XRPL uses a unique consensus protocol where designated validators on the network collectively agree on the order and validity of transactions. This approach eliminates the need for energy-intensive mining and allows for much faster transaction processing.

Speed and Scalability: The XRPL can handle approximately 1,500 transactions per second (TPS), with the potential to scale further. This significantly surpasses Bitcoin's ~7 TPS and even outpaces traditional payment networks like Visa in terms of raw throughput capability.

Low Transaction Costs: Transaction fees on the XRPL are incredibly low, typically fractions of a cent. This makes it ideal for microtransactions and high-volume payment scenarios.

Energy Efficiency: The XRPL's consensus mechanism is highly energy-efficient compared to Proof-of-Work blockchains. This aligns with the growing global focus

Built-in Decentralized Exchange (DEX): The XRPL features a native DEX that allows users to trade various digital assets directly on the ledger. This eliminates the need for intermediaries and provides a seamless trading experience.

Tokenization Capabilities: The XRPL is designed to facilitate the creation and management of tokenized assets. This opens up possibilities for representing real-world assets like real estate, commodities, and even currencies on the blockchain, enabling more efficient and transparent transfer of value.

Evolving Smart Contract Functionality: While not as feature-rich as Ethereum in terms of smart contracts, the XRPL is evolving to incorporate more advanced smart contract capabilities through features like "Hooks" and federated sidechains. These advancements will expand the range of applications that can be built on the XRPL.

Real-World Use Cases Beyond Payments

The XRPL's capabilities extend beyond just facilitating payments, opening doors to a wide range of potential applications:

Tokenization of Assets: As mentioned, the XRPL can be used to tokenize various assets, creating digital representations of real-world items. This can revolutionize ownership and transfer of assets, making them more liquid and accessible.

Decentralized Finance (DeFi): While still in its early stages on the XRPL, DeFi applications are emerging, leveraging the ledger's speed, low cost, and built-in DEX for lending, borrowing, yield farming, and other financial activities.

Central Bank Digital Currencies (CBDCs): The XRPL's scalability, security, and efficiency make it a strong contender for powering CBDCs. Ripple is actively collaborating with central banks globally on CBDC pilot projects.

Supply Chain Management: The XRPL's transparency and traceability features can be used to track goods and materials throughout the supply chain, improving efficiency, reducing fraud, and enhancing accountability.

Digital Identity: The XRPL can potentially be used to create and manage secure digital identities, enabling more efficient and privacy-preserving verification processes.

Gaming and NFTs: The XRPL's low transaction fees and fast settlement times make it suitable for in-game economies and the trading of Non-Fungible Tokens (NFTs).

Security and Decentralization

The XRPL is maintained by a network of independent validators globally. This decentralized structure enhances the security and resilience of the ledger, making it resistant to censorship and single points of failure. The consensus protocol ensures that transactions are validated and added to the ledger in a secure and efficient manner.

Future Developments and Enhancements

Ripple and the broader XRPL community are continuously working on enhancing the ledger's capabilities:

Federated Sidechains: This technology will allow developers to create specialized blockchains that connect to the main XRPL, enabling greater flexibility and customization for different use cases.

Advanced Smart Contract Functionality: Further development of smart contract capabilities will expand the range of applications that can be built on the XRPL, particularly in DeFi and other areas requiring complex logic.

Interoperability: Efforts are underway to improve interoperability between the XRPL and other blockchains, enabling seamless asset transfers and communication across different networks.

Conclusion: A Versatile Platform for the Future of Transactions

The XRP Ledger is more than just the backbone of XRP; it's a versatile and powerful blockchain platform with the potential to revolutionize various industries beyond payments. Its speed, scalability, low cost, energy efficiency, and evolving feature set make it a strong contender for powering the future of transactions in a rapidly digitalizing world. As development continues and adoption grows, the XRPL is poised to play an increasingly significant role in shaping the future of finance and beyond.

Chapter 8: Ripple USD (RLUSD): Bridging the Gap Between Fiat and Crypto on XRPL

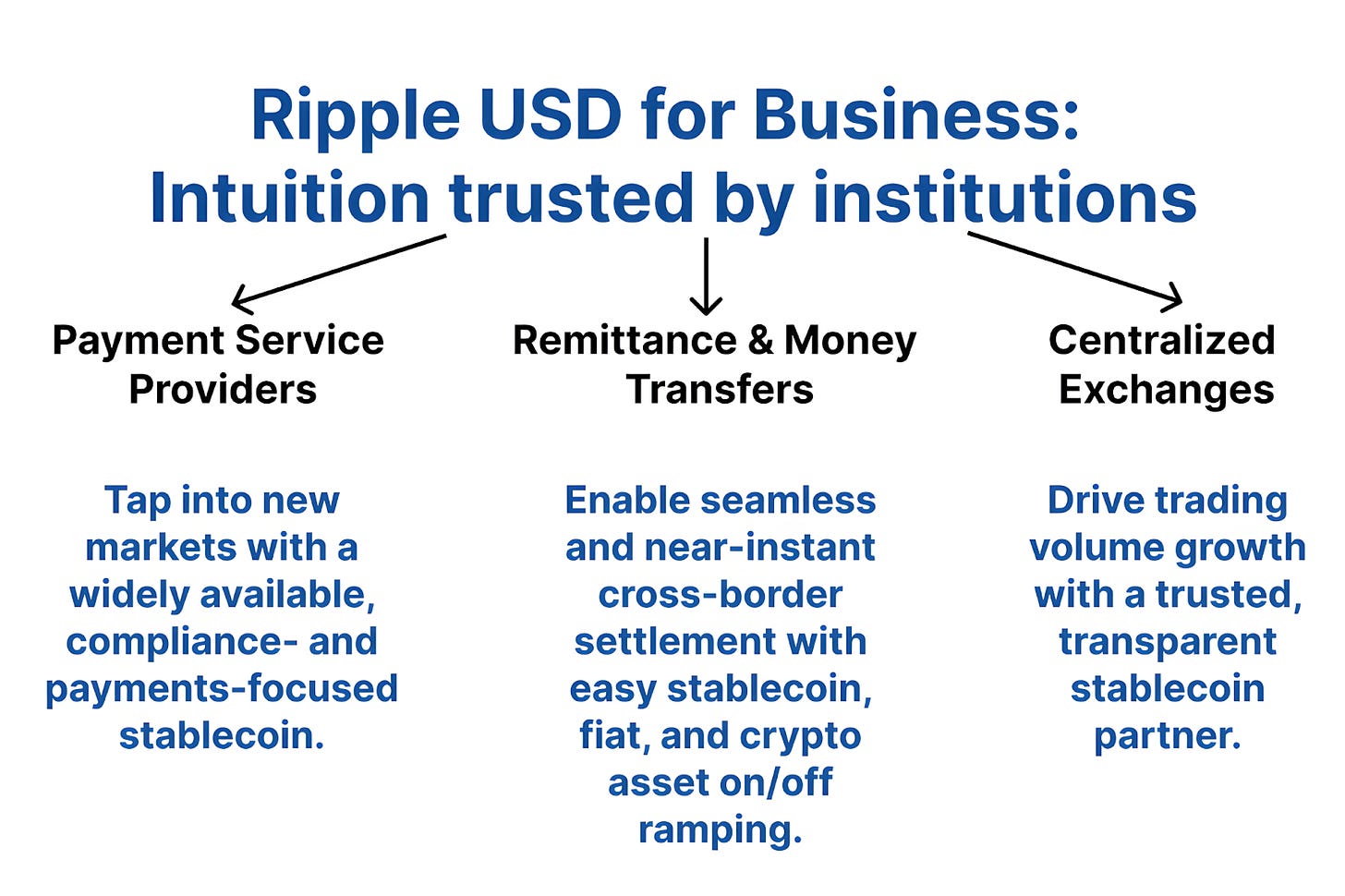

Ripple's launch of its USD-backed stablecoin, RLUSD, marks a significant development in the evolution of the XRP Ledger (XRPL) ecosystem. RLUSD is designed to bridge the gap between traditional fiat currency (USD) and the world of digital assets, offering stability and enhanced utility within the XRPL environment.

What is RLUSD and How Does it Work?

RLUSD is a stablecoin, meaning its value is pegged 1:1 to the US dollar. This peg is maintained through reserves held by Ripple, ensuring that each RLUSD token is backed by an equivalent amount of USD or USD-equivalent assets. This backing mechanism provides price stability, making RLUSD a reliable digital representation of the US dollar on the XRPL.

Key Features and Benefits of RLUSD:

Price Stability: As a stablecoin, RLUSD aims to maintain a stable value, minimizing the volatility associated with many other cryptocurrencies. This makes it suitable for everyday transactions and as a store of value within the XRPL ecosystem.

Fast and Low-Cost Transactions: Built on the XRPL, RLUSD inherits the ledger's speed and efficiency. Transactions settle in seconds with minimal fees, making it ideal for cross-border payments and other high-frequency use cases.

Transparency and Audits: Ripple has committed to transparency regarding the reserves backing RLUSD. Regular audits by independent accounting firms will help ensure that the 1:1 peg is maintained and build trust with users.

Interoperability within the XRPL Ecosystem: RLUSD is designed to be seamlessly integrated with other applications and services built on the XRPL, including the native DEX and emerging DeFi protocols.

Use Cases of RLUSD on the XRPL:

Cross-Border Payments with Stability: Businesses and individuals can use RLUSD for international payments, leveraging the XRPL's speed and low cost while mitigating the risk of price volatility during the transaction process.

Foundation for DeFi on XRPL: RLUSD can serve as a core building block for Decentralized Finance (DeFi) applications on the XRPL. Its stability makes it an attractive asset for lending, borrowing, yield farming, and other DeFi activities.

On-Ramp and Off-Ramp for Fiat: RLUSD provides a seamless pathway for users to move funds between traditional bank accounts and the XRPL ecosystem. This makes it easier to access and utilize digital assets on the XRPL.

Potential Bridge for CBDCs: RLUSD's design could potentially facilitate interoperability with future Central Bank Digital Currencies (CBDCs), enabling seamless exchange between different digital currencies.

Trading and Hedging: Traders can use RLUSD as a stable asset for trading on the XRPL's DEX or for hedging against volatility in other cryptocurrencies.

RLUSD vs. Other Stablecoins:

While RLUSD enters a market with established stablecoins like USDT and USDC, it offers several potential advantages:

Integration with the XRPL: RLUSD is native to the XRPL, providing seamless integration with its features and applications.

Leveraging Ripple's Network: Ripple's extensive network of partnerships with financial institutions could drive adoption of RLUSD for cross-border payments and other enterprise use cases.

Focus on Compliance and Transparency: Ripple emphasizes compliance and transparency, which could make RLUSD more attractive to institutions and users seeking a regulated and trustworthy stablecoin.

Challenges and Considerations:

Regulatory Landscape: The regulatory environment for stablecoins is still evolving globally. Clarity and consistent regulations will be crucial for the long-term success of RLUSD.

Competition: RLUSD faces competition from established stablecoins with larger market share and network effects.

Maintaining the Peg: Ensuring the 1:1 peg with the USD is maintained through robust reserve management and transparent audits is critical for building trust and long-term stability.

Adoption and Ecosystem Growth: The success of RLUSD will depend on its adoption by users, businesses, and developers within the XRPL ecosystem.

Conclusion: A Key Building Block for the XRPL Ecosystem

RLUSD represents a strategic move by Ripple to enhance the utility and adoption of the XRP Ledger. By providing a stable, USD-backed digital asset on the XRPL, RLUSD has the potential to become a key building block for a thriving ecosystem of payments, DeFi applications, and other innovative use cases. While challenges remain, the launch of RLUSD is a significant step towards bridging the gap between traditional finance and the rapidly evolving world of digital assets.

Chapter 9: Strategic Partnerships: Building the Ripple Ecosystem Globally

Ripple's strategy for driving adoption of XRP and the XRPL has heavily relied on forging strategic partnerships with key players across various sectors of the global financial landscape. These partnerships are not just symbolic; they are actively building a robust and expanding ecosystem for blockchain-based finance.

Types of Partnerships and Their Strategic Importance

Ripple's partnerships can be broadly categorized into the following:

Financial Institutions: This is a cornerstone of Ripple's strategy. Partnerships with banks, payment providers, and other financial institutions are crucial for driving adoption of RippleNet and On-Demand Liquidity (ODL), which utilizes XRP for cross-border payments. These partnerships enable faster, cheaper, and more efficient international transactions. Examples include Santander, Bank of America, and many others globally.

Technology Companies: Collaborations with technology companies help Ripple integrate its solutions with existing infrastructure, expand the reach of the XRPL, and develop new applications on the ledger.

Governments and Central Banks: Ripple is actively engaging with governments and central banks worldwide to explore the potential of blockchain technology, particularly in the development of Central Bank Digital Currencies (CBDCs). The XRPL's capabilities make it a strong contender for powering CBDC initiatives. Ripple has announced pilot projects in countries like Bhutan and Palau.

Fintech Companies: Partnerships with innovative fintech companies help Ripple expand into new markets, develop new use cases for XRP and the XRPL, and foster a more vibrant ecosystem. These partnerships often focus on areas like remittances, microfinance, and DeFi.

Exchanges and Liquidity Providers: Collaborations with cryptocurrency exchanges and liquidity providers are essential for ensuring sufficient liquidity for XRP and facilitating its use in ODL and other applications.

Impact of Partnerships on Adoption and Ecosystem Growth

Ripple's strategic partnerships have had a tangible impact on the adoption of XRP and the growth of the Ripple ecosystem:

Expansion of RippleNet and ODL Corridors: Partnerships have led to a significant expansion of RippleNet, Ripple's global payments network, and the number of ODL corridors, enabling faster and cheaper cross-border payments in more regions.

Increased Transaction Volumes: As more financial institutions utilize RippleNet and ODL, transaction volumes involving XRP have grown, demonstrating real-world usage and demand for the digital asset.

Geographic Expansion: Partnerships have facilitated Ripple's expansion into new markets globally, particularly in regions with high remittance flows and a need for more efficient cross-border payment solutions.

Development of New Use Cases: Collaborations with technology and fintech companies have spurred the development of new applications and use cases for XRP and the XRPL beyond payments, including tokenization, DeFi, and supply chain management.

Enhanced Credibility and Trust: Partnerships with reputable financial institutions and government entities enhance Ripple's credibility and build trust in its technology and solutions.

Examples of Key Partnerships

Santander: One of the earliest and most prominent partners, Santander has integrated Ripple's technology to improve cross-border payments for its customers.

SBI Holdings (Japan): SBI Remit, a subsidiary of SBI Holdings, has been a major partner in driving XRP adoption in Asia, particularly for remittances.

MoneyGram (Past Partnership): While the partnership has ended, MoneyGram's integration of Ripple's ODL solution for a period demonstrated the potential for XRP to disrupt the remittance industry.

bKash (Bangladesh): This partnership is focused on enabling faster and more affordable remittances to Bangladesh, a country with a large প্রবাসী population.

National Bank of Egypt: This more recent partnership aims to improve cross-border payment efficiency for Egypt.

Challenges and Future Outlook

Despite the success of its partnership strategy, Ripple faces ongoing challenges:

Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies, particularly in the US, remains a hurdle for broader institutional adoption.

Competition: Ripple faces competition from both traditional financial institutions and other blockchain-based payment solutions.

Maintaining Momentum: Sustaining the momentum of partnership growth and translating partnerships into widespread adoption requires continuous effort and innovation.

Conclusion: Partnerships as a Cornerstone of Growth

Strategic partnerships are a cornerstone of Ripple's strategy for driving adoption of XRP and the XRPL. By collaborating with a diverse range of players across the financial ecosystem, Ripple is building a robust network that is transforming cross-border payments and laying the foundation for a more efficient and inclusive global financial system. The continued success of this partnership-driven approach will be crucial for realizing the full potential of XRP and the digital asset revolution.

Chapter 10: Bitcoin: The Pioneering Store of Value (Origins and Current Role)

Bitcoin, the world's first cryptocurrency, has played a pivotal role in shaping the digital asset landscape. While initially conceived as a peer-to-peer electronic cash system, its primary narrative has evolved, and it is now widely regarded as a "store of value" or "digital gold." Understanding Bitcoin's origins, its current role, and its relationship to other assets like XRP is crucial for a comprehensive view of the crypto ecosystem.

Origins and the Genesis Block

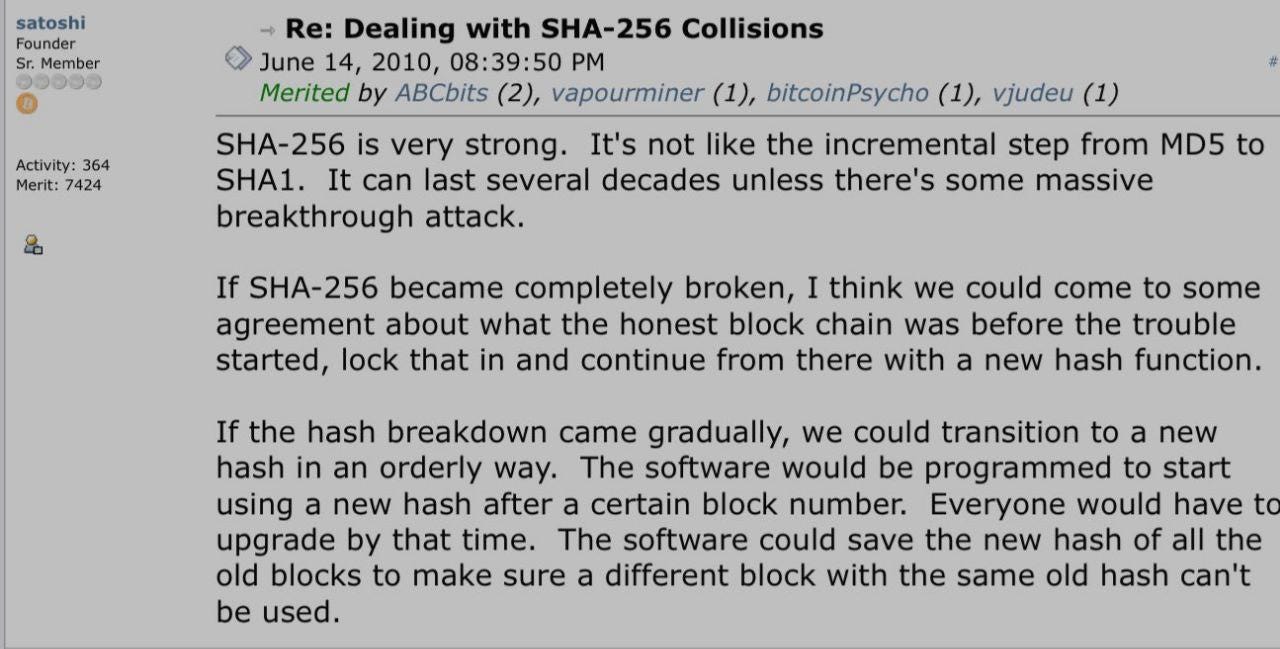

Bitcoin was created by an anonymous individual or group known as Satoshi Nakamoto, who published the Bitcoin whitepaper in 2008. The first Bitcoin block, known as the "genesis block," was mined in January 2009, marking the birth of the Bitcoin blockchain.

Key Features of Bitcoin's Design

Decentralization: Bitcoin operates on a decentralized network of computers (nodes) distributed globally, with no single point of control or failure. This makes it resistant to censorship and manipulation.

Proof-of-Work (PoW) Consensus: Bitcoin uses a PoW consensus mechanism where miners compete to solve complex mathematical problems to validate transactions and add new blocks to the blockchain. This process secures the network but is energy-intensive.

Limited Supply: Bitcoin has a fixed supply of 21 million coins, which are gradually released into circulation through mining. This scarcity is a key factor driving its store-of-value narrative.

Transparency: All Bitcoin transactions are recorded on a public, immutable ledger (the blockchain), making them transparent and auditable.

Pseudonymity: While transactions are public, the identities of users are not directly tied to their addresses, providing a degree of pseudonymity.

Evolution from "Digital Cash" to "Digital Gold"

While Satoshi's whitepaper envisioned Bitcoin as a peer-to-peer electronic cash system, its primary use case has shifted over time. Several factors contributed to this evolution:

Scalability Limitations: Bitcoin's relatively slow transaction processing speed (around 7 transactions per second) and potential for high transaction fees during periods of network congestion make it less practical for everyday payments compared to newer, more scalable blockchains.

Volatility: Bitcoin's price volatility, while potentially attractive to some investors, makes it less suitable as a stable medium of exchange for everyday transactions.

Store-of-Value Narrative: The limited supply, decentralized nature, and increasing institutional interest have solidified Bitcoin's narrative as a store of value, a hedge against inflation, and a long-term investment asset, similar to gold.

Bitcoin's Current Role in the Crypto Ecosystem

Store of Value: Bitcoin is increasingly seen as a store of value, particularly by institutional investors seeking to diversify their portfolios and hedge against inflation. Companies like MicroStrategy and Tesla have made significant investments in Bitcoin.

Reserve Asset: Some proponents view Bitcoin as a potential reserve asset for individuals, corporations, and even nation-states, particularly in countries with unstable currencies or high inflation.

Gateway to Crypto: Bitcoin often serves as a gateway to the broader cryptocurrency market. Many investors first enter the crypto space by purchasing Bitcoin, and it is a common trading pair on most exchanges.

"Digital Gold" Narrative: The comparison of Bitcoin to gold has become increasingly prevalent, emphasizing its scarcity, durability, and potential as a safe-haven asset.

Bitcoin's Relationship with XRP and Other Cryptocurrencies

Distinct Use Cases: Bitcoin and XRP serve different primary purposes. Bitcoin is primarily a store of value, while XRP is designed for utility in payments and liquidity.

Market Correlation: Bitcoin's price movements often influence the broader cryptocurrency market, including XRP. However, XRP's price is also influenced by factors specific to its ecosystem, such as adoption of ODL and regulatory developments.

Complementary Assets: Bitcoin and XRP can be seen as complementary assets within a diversified crypto portfolio. Bitcoin provides exposure to the store-of-value narrative, while XRP offers exposure to the growing utility of blockchain in payments and finance.

Challenges and Future Outlook

Bitcoin faces several challenges:

Scalability: Layer 2 solutions like the Lightning Network are being developed to address Bitcoin's scalability limitations, but their widespread adoption is still ongoing.

Energy Consumption: Bitcoin's Proof-of-Work consensus mechanism is energy-intensive, raising environmental concerns.

Regulatory Uncertainty: The regulatory landscape for Bitcoin and cryptocurrencies is still evolving globally.

Despite these challenges, Bitcoin remains the most prominent and widely recognized cryptocurrency. Its future will likely be shaped by factors such as institutional adoption, regulatory developments, technological advancements (like Layer 2 solutions), and its continued evolution as a store of value in an increasingly digital world.

Conclusion: A Foundation for the Digital Asset Revolution

Bitcoin's pioneering role in launching the cryptocurrency revolution is undeniable. While its primary use case has shifted from "digital cash" to "digital gold," it remains a foundational asset in the crypto ecosystem. Its store-of-value narrative, increasing institutional adoption, and continued development ensure that Bitcoin will likely play a significant role in the future of finance, alongside utility-focused assets like XRP that are driving innovation in specific sectors.

Chapter 11: XLM: Stellar – A Network with Shared Vision, Different Focus (A Close Cousin)

Stellar (XLM) is another prominent cryptocurrency and blockchain network that often draws comparisons to Ripple (XRP) due to their shared vision of improving cross-border payments and financial inclusion. However, there are key differences in their technical architecture, target audiences, and overall approach.

Shared Vision: Financial Inclusion and Efficient Cross-Border Payments

Both Stellar and Ripple were founded with the goal of making financial services more accessible and efficient, particularly for cross-border transactions and remittances. They both aim to:

Reduce Transaction Costs: Both networks offer significantly lower transaction fees compared to traditional banking systems, making them attractive for remittances and microtransactions.

Increase Transaction Speed: Both Stellar and Ripple can process transactions much faster than traditional systems, enabling near-instant settlement.

Promote Financial Inclusion: Both projects aim to bring financial services to underserved populations, particularly in developing economies.

Key Differences: Technology, Target Audience, and Approach

Despite their shared vision, Stellar and Ripple differ significantly in several key areas:

Consensus Mechanism:

Stellar: Uses the Stellar Consensus Protocol (SCP), a Federated Byzantine Agreement (FBA) system where a network of trusted nodes (quorum slices) validates transactions.

Ripple (XRP): Uses the XRP Ledger Consensus Protocol, a unique consensus mechanism where designated validators collectively agree on transaction order and validity.

Target Audience:

Stellar: Historically focused more on individual users, non-profit organizations, and smaller-scale remittances, particularly in developing economies.

Ripple: Primarily targets financial institutions, payment providers, and enterprises, focusing on large-scale cross-border payments and liquidity solutions.

Network Structure:

Stellar: More decentralized in terms of node operation, with a wider range of individuals and organizations running nodes.

Ripple: Historically more centralized in terms of validator selection, although efforts are underway to further decentralize the network.

Token Distribution:

Stellar (XLM): The Stellar Development Foundation (SDF) initially held a large portion of XLM tokens, with plans to distribute them over time to promote adoption and ecosystem growth.

Ripple (XRP): Ripple Labs initially held a significant portion of XRP tokens, and has placed a large portion in escrow, releasing them periodically.

Ecosystem and Partnerships:

Stellar: Has partnerships with various organizations, including non-profits, fintech companies, and businesses, particularly in emerging markets. Focuses on use cases like remittances, microfinance, and tokenization of assets.

Ripple: Primarily partners with financial institutions, payment providers, and enterprises, focusing on cross-border payments, liquidity management, and enterprise blockchain solutions.

XLM: The Native Asset of the Stellar Network

XLM is the native cryptocurrency of the Stellar network. It serves several key functions:

Transaction Fees: XLM is used to pay transaction fees on the Stellar network, which are typically very low (fractions of a cent).

Anti-Spam Mechanism: A small amount of XLM is required to create an account and hold assets on the Stellar network, deterring spam and ensuring network integrity.

Bridge Currency: XLM can be used as a bridge currency for facilitating trades between different assets on the Stellar network's decentralized exchange.

Stellar's Strengths and Use Cases

Remittances: Stellar has been particularly successful in facilitating remittances, offering a low-cost and fast alternative to traditional remittance providers.

Microfinance: Stellar's low transaction fees make it suitable for microfinance applications, enabling small loans and payments in developing economies.

Tokenization: The Stellar network can be used to create and manage tokenized assets, representing real-world assets or other digital assets.

Cross-Border Payments: While also a focus of Ripple, Stellar has gained traction in facilitating cross-border payments, particularly for smaller-scale transactions.

Stellar and Ripple: Complementary Networks

While often compared, Stellar and Ripple can be seen as complementary networks, each addressing different segments of the market and contributing to the broader goal of financial inclusion and efficiency.

Stellar: More focused on individual users, smaller-scale remittances, and non-profit organizations, particularly in emerging markets.

Ripple: More focused on financial institutions, enterprises, and large-scale cross-border payments.

Conclusion: A Shared Vision, Different Paths

Stellar and Ripple share a vision of leveraging blockchain technology to improve global finance. However, they have taken different paths in terms of technology, target audience, and ecosystem development. Stellar, with its focus on individual users and emerging markets, and Ripple, with its focus on financial institutions and enterprise solutions, are both contributing to a more inclusive and efficient financial future. The existence of multiple networks with similar goals but different approaches can foster innovation and provide a wider range of solutions for the diverse needs of the global financial landscape.

Chapter 12: The Evolving Regulatory Landscape: Charting a Course for Digital Assets

The regulatory landscape for cryptocurrencies and blockchain technology is constantly evolving, creating both challenges and opportunities for projects like Ripple (XRP) and the broader digital asset ecosystem. Navigating this complex and often uncertain environment is crucial for the long-term growth and mainstream adoption of cryptocurrencies.

Global Regulatory Fragmentation

One of the most significant challenges is the lack of a unified global regulatory framework for digital assets. Different jurisdictions have adopted varying approaches, leading to a fragmented and sometimes conflicting landscape:

United States: The US has a complex regulatory environment with multiple agencies (SEC, CFTC, FinCEN) asserting jurisdiction over different aspects of cryptocurrencies. The ongoing debate about whether certain cryptocurrencies, including XRP, are securities has created significant uncertainty. The partial court ruling in the Ripple case provided some clarity but also highlighted the need for more comprehensive legislation.

European Union: The EU's Markets in Crypto-Assets (MiCA) regulation, expected to be fully implemented in 2024, represents a major step towards a harmonized regulatory framework for crypto-assets in Europe. MiCA aims to provide legal certainty, protect consumers, and foster innovation in the crypto space.

Asia: Regulatory approaches in Asia vary widely. Some countries, like Japan and Singapore, have adopted more progressive and crypto-friendly regulations, while others have taken a more cautious or restrictive stance.

Other Regions: Many other countries are still in the process of developing their regulatory frameworks for cryptocurrencies, creating a patchwork of different rules and requirements globally.

Key Regulatory Considerations for Digital Assets

Regulators worldwide are grappling with several key issues related to cryptocurrencies:

Classification of Cryptocurrencies: Determining whether cryptocurrencies are securities, commodities, currencies, or a new asset class altogether is a fundamental question with significant legal and regulatory implications.

Anti-Money Laundering (AML) and Know Your Customer (KYC): Regulators are focused on preventing the use of cryptocurrencies for illicit activities like money laundering and terrorist financing. AML and KYC regulations are being implemented globally to address these concerns.

Consumer Protection: Protecting consumers from fraud, scams, and market manipulation is a priority for regulators. This includes addressing issues like custody, disclosure, and market integrity.

Taxation: The tax treatment of cryptocurrencies varies across jurisdictions and is still evolving. Clear tax guidelines are needed for individuals and businesses involved in crypto transactions and investments.

Stablecoin Regulation: Stablecoins, like RLUSD, have drawn particular attention from regulators due to their potential impact on financial stability. Regulations are being developed to address issues like reserve requirements, auditing, and systemic risk.

Central Bank Digital Currencies (CBDCs): The emergence of CBDCs is another significant development that will interact with the existing cryptocurrency landscape. Regulators are exploring how CBDCs will be regulated and how they will coexist with private cryptocurrencies.

Ripple's Approach to Regulation

Ripple has adopted a proactive approach to engaging with regulators globally:

Advocacy for Clear and Sensible Regulations: Ripple advocates for regulatory frameworks that foster innovation while addressing legitimate concerns about risk and consumer protection.

Compliance Focus: Ripple emphasizes compliance with existing regulations and has implemented AML and KYC procedures in its products and services.

Transparency: Ripple aims to be transparent in its operations and communications, particularly regarding the distribution of XRP and the reserves backing RLUSD.

Collaboration with Regulators: Ripple actively engages with regulators and policymakers worldwide, participating in industry discussions and providing input on regulatory proposals.

Opportunities and Challenges in the Evolving Landscape

The evolving regulatory landscape presents both opportunities and challenges for Ripple and the broader crypto industry:

Opportunities:

Regulatory clarity can unlock institutional adoption: Clear and reasonable regulations can provide the certainty that institutional investors need to enter the crypto market, driving significant growth.

Innovation can flourish in a well-regulated environment: A well-defined regulatory framework can foster innovation by providing clear guidelines and reducing legal risks for developers and entrepreneurs.

Increased consumer confidence: Appropriate regulations can enhance consumer protection and build trust in the crypto industry, leading to broader adoption.

Challenges:

Regulatory uncertainty can stifle innovation and adoption: Lack of clarity and constantly changing rules can create uncertainty and hinder investment and development.

Overly restrictive regulations can drive activity underground or offshore: Regulations that are too burdensome or restrictive can push crypto activity into less regulated or unregulated spaces, making it harder to monitor and control.

Compliance costs can be significant: Meeting regulatory requirements can be costly, particularly for smaller startups and projects.

Conclusion: A Defining Factor for the Future of Digital Assets

The regulatory landscape is a critical factor that will shape the future of digital assets like XRP and the broader cryptocurrency industry. While challenges remain, the ongoing evolution of regulations presents an opportunity to create a more stable, transparent, and innovative environment for the growth of the digital economy. Proactive engagement with regulators, a commitment to compliance, and a focus on building trust will be essential for navigating this evolving landscape and realizing the full potential of blockchain technology and digital assets.

Chapter 13: Hedera Hashgraph and HBAR: Exploring Alternative Distributed Ledger Technologies

While blockchain technology has captured significant attention, it's not the only form of Distributed Ledger Technology (DLT) available. Hedera Hashgraph, with its native token HBAR, represents a compelling alternative that utilizes a different underlying architecture called a Hashgraph. Understanding Hedera and its unique approach provides a broader perspective on the evolving DLT landscape.

What is Hedera Hashgraph?

Hedera Hashgraph is a public, enterprise-grade DLT that uses a patented Hashgraph consensus algorithm instead of a traditional blockchain. This algorithm, invented by Leemon Baird, enables Hedera to achieve high throughput, fast finality, and strong security while maintaining fairness and low energy consumption.

Key Features and Differences from Blockchain:

Directed Acyclic Graph (DAG) Structure: Unlike blockchains that organize transactions into sequential blocks, Hedera uses a DAG structure where transactions are linked together in a more interconnected web. This allows for parallel processing of transactions, contributing to higher throughput.

Gossip-about-Gossip Protocol: Hedera's consensus mechanism relies on a "gossip-about-gossip" protocol where nodes rapidly share information about transactions and the order in which they occurred. This enables the network to reach consensus quickly and efficiently.

Asynchronous Byzantine Fault Tolerance (aBFT): Hedera's consensus algorithm achieves aBFT, considered the highest level of security for distributed systems. This means the network can function correctly even if some nodes are malicious or faulty.

Fairness: Hedera's algorithm ensures that transactions are ordered fairly based on their timestamps, preventing manipulation or front-running.

High Throughput: Hedera boasts a very high transaction throughput, capable of handling thousands of transactions per second, significantly exceeding the capacity of many blockchains.

Fast Finality: Transactions on Hedera achieve finality in seconds, meaning they are irreversible and confirmed quickly.

Low and Fixed Fees: Hedera offers low and predictable transaction fees, making it attractive for enterprise use cases.

Energy Efficiency: Hedera's Hashgraph consensus is significantly more energy-efficient than Proof-of-Work blockchains.

HBAR: The Native Token of the Hedera Network

HBAR is the native cryptocurrency of the Hedera network. It serves several key functions:

Transaction Fees: HBAR is used to pay for transactions and other operations on the Hedera network.

Network Security: HBAR is used for staking, where token holders can participate in securing the network and earn rewards. (Note: Hedera's staking model is still under development).

Smart Contract Execution: HBAR is used to pay for the execution of smart contracts on the Hedera network.

Hedera's Focus on Enterprise Adoption

Hedera has positioned itself as an enterprise-grade DLT, focusing on use cases that require high throughput, fast finality, security, and stability.

Key Use Cases:

Payments and Micropayments: Hedera's speed and low fees make it suitable for various payment applications, including micropayments.

Tokenized Assets: Hedera can be used to create and manage tokenized assets, representing real-world assets or digital assets.

Supply Chain Management: Hedera's transparency and traceability features can be leveraged to track goods and materials throughout the supply chain.

Decentralized Identity: Hedera can be used to create and manage secure and verifiable digital identities.

Gaming and NFTs: Hedera's high throughput and low fees make it suitable for in-game economies and the trading of NFTs.

Data Integrity and Auditing: Hedera can be used to create tamper-proof records and audit trails for various types of data.

Hedera's Governing Council:

Hedera is governed by the Hedera Governing Council, a group of leading organizations from diverse industries and geographies. This council provides oversight and guidance for the development and evolution of the Hedera network. Members of the council include companies like Google, IBM, Boeing, LG, and others.

Hedera vs. XRP and Other Cryptocurrencies:

While Hedera shares some similarities with Ripple (XRP) in its focus on speed and efficiency, there are key differences:

Technology: Hedera uses a Hashgraph, while Ripple uses a blockchain (XRPL).

Consensus: Hedera's gossip-about-gossip protocol differs significantly from the XRPL's consensus mechanism.

Target Audience: While both target enterprises, Hedera's use cases are broader, while Ripple's primary focus is on payments and liquidity.

Governance: Hedera's Governing Council provides a more structured governance model compared to the more decentralized governance of the XRPL.

Conclusion: A Viable Alternative in the DLT Landscape

Hedera Hashgraph, with its unique Hashgraph technology and enterprise focus, offers a compelling alternative to traditional blockchains. Its high throughput, fast finality, strong security, and low energy consumption make it well-suited for a wide range of applications. While the cryptocurrency space is often dominated by blockchain discussions, exploring alternative DLTs like Hedera provides a broader perspective on the evolving landscape of decentralized technologies and their potential to transform various industries. Hedera and blockchain-based solutions like XRP can coexist and even complement each other, offering diverse solutions for the growing needs of the digital economy.

Chapter 14: Ripple Liquidity Hub and Enterprise Solutions: Expanding Adoption

Beyond On-Demand Liquidity (ODL) for cross-border payments, Ripple is actively expanding its suite of enterprise solutions to drive broader adoption of XRP, the XRPL, and blockchain technology in general. A key initiative in this direction is the Ripple Liquidity Hub, designed to streamline crypto liquidity access for businesses.

Ripple Liquidity Hub: A Gateway to Crypto Liquidity

The Ripple Liquidity Hub is a turnkey solution aimed at simplifying the complexities of accessing and managing crypto liquidity for financial institutions and enterprises. It acts as a single point of integration for businesses to source liquidity from various crypto exchanges, market makers, and Over-the-Counter (OTC) desks.

Key Features and Benefits:

Simplified Access: The Liquidity Hub abstracts away the complexities of interacting with multiple crypto exchanges and liquidity providers. Instead of managing numerous APIs and accounts, businesses can access a unified platform.

Smart Order Routing: The Hub incorporates intelligent order routing capabilities, dynamically directing trades across different liquidity venues to optimize for price, execution speed, and liquidity depth. This helps ensure businesses get the best possible rates when buying or selling cryptocurrencies.

Support for Multiple Cryptocurrencies (Including XRP): While XRP is a central focus, the Liquidity Hub is designed to support a range of cryptocurrencies, allowing businesses to access liquidity for various digital assets as needed. This diversification is crucial for catering to different enterprise use cases.

Turnkey Solution: The Liquidity Hub is offered as a turnkey solution, meaning that Ripple handles the technical complexities of integration, connectivity, and ongoing management. This allows businesses to quickly and easily access crypto liquidity without significant in-house development effort.

Compliance and Security Focus: Ripple emphasizes compliance and security in the Liquidity Hub, understanding the stringent requirements of financial institutions. The platform incorporates robust AML/KYC protocols and security measures to meet industry standards and regulatory expectations.

Enterprise Solutions Beyond Payments: Expanding Use Cases

While cross-border payments remain a core focus, Ripple is actively exploring and developing enterprise solutions that leverage XRP and the XRPL for a wider range of use cases:

Tokenized Assets and Corporate Treasury: Enterprises are increasingly exploring the potential of tokenizing real-world assets and managing corporate treasury functions using blockchain technology. The XRPL's tokenization capabilities and XRP's efficiency make it well-suited for these applications. For example, companies could tokenize bonds, commodities, or even real estate on the XRPL for faster and more efficient transfer and management.

Central Bank Digital Currencies (CBDCs): Ripple is actively engaged in partnering with central banks to develop and pilot CBDCs. The XRPL's scalability, security, and energy efficiency make it an attractive infrastructure for CBDC issuance and management. Over 80% of central banks are exploring CBDCs, according to a 2023 survey by the Bank for International Settlements (BIS) [Source: BIS]. Ripple's technology is being used in CBDC pilots in countries like Bhutan and Palau [Source: Ripple Insights].

Supply Chain Finance and Traceability: Blockchain technology offers significant advantages for supply chain management, including enhanced transparency and traceability. The XRPL could be used to track goods, manage payments, and streamline supply chain finance processes. This can lead to greater efficiency, reduced fraud, and improved visibility across complex

Decentralized Finance (DeFi) for Institutions: While DeFi is often associated with retail users, institutions are also beginning to explore its potential. Ripple is working to bridge the gap between traditional finance and DeFi, creating solutions that allow institutions to participate in DeFi in a compliant and secure manner. This could involve using XRP, RLUSD, and the XRPL for institutional-grade DeFi applications such as lending, borrowing, and yield generation.

Driving Broader Adoption: A Multi-faceted Approach

Ripple's strategy for driving broader adoption of XRP and its enterprise solutions is multi-faceted:

Strategic Partnerships: Continued focus on forging strategic partnerships with financial institutions, payment providers, technology companies, and governments to expand the Ripple ecosystem and drive real-world usage. (As discussed in Chapter 9).

Developer Ecosystem Growth: Investing in growing the developer ecosystem around the XRPL. This includes providing developer tools, documentation, resources, and support to encourage the creation of new applications and use cases on the XRPL. Ripple's University Blockchain Research Initiative (UBRI) is an example of this, partnering with over 40 universities globally to foster blockchain education and research [Source: Ripple UBRI].

Regulatory Engagement: Proactive engagement with regulators globally to advocate for clear and sensible regulations that foster innovation while ensuring consumer protection. (As discussed in Chapter 12).